Elliott wanted to learn if “there was any rhyme or reason to the stock market”

In the 1930s, Ralph Nelson Elliott (1871-1948) discovered that the stock market moves in recurring patterns that he called waves.

I’m writing on July 28, which is his 152nd birthday, so it’s an appropriate time to pay tribute to this extraordinary man, his work and the unusual circumstances under which he discovered the Wave Principle.

Elliott led an active life as an accountant and management consultant, working at various times for railroad companies in Mexico, Central America and South America, a business magazine, and for the State Department before becoming seriously ill with pernicious anemia.

In the book, R.N. Elliott’s Masterworks, Elliott Wave International President Robert Prechter describes what happened next:

Despite being physically debilitated by his malady, Elliott needed something to occupy his acute mind while recuperating between its worst attacks… It was around 1932 that Elliott began turning his full attention to… finding out whether there was any rhyme or reason to the stock market. …

Around May 1934… his numerous observations of general stock market behavior began falling together into a general set of principles that applied to all degrees of wave movement in the stock price averages.

Elliott’s insights continue to be used by investors today.

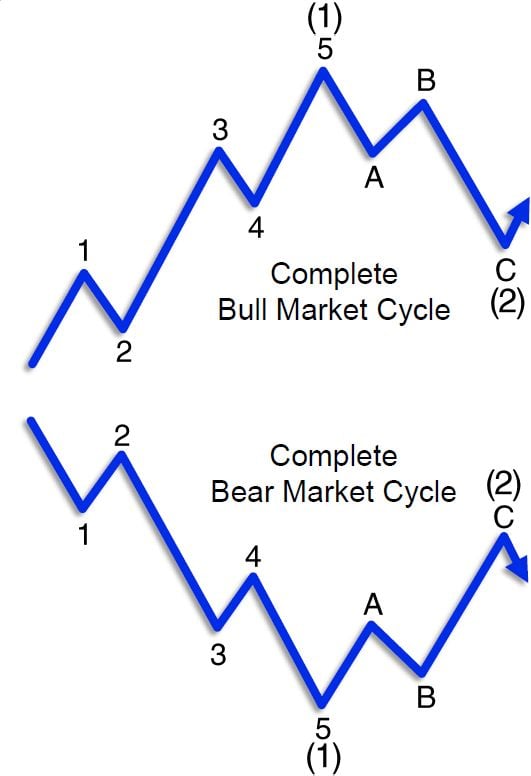

The basic Elliott wave pattern consists of five subwaves (denoted by numbers) which move in the same direction as the trend of the next larger size and three corrective subwaves (denoted by letters) which move against the trend of the next larger size:

When this initial eight-wave cycle as shown by the illustration ends, a similar cycle begins.

In other words, the basic Elliott wave pattern links to form five- and three-wave structures of increasingly larger size.

An important point is that the Wave Principle helps investors to identify turning points in the trends of financial markets.

Follow the link below to learn what the waves are suggesting are next for U.S. stocks, bonds, gold, silver, the U.S. dollar and more.

True or False?

“Most Investors are on the WRONG SIDE of major market turns”

It’s true.

Here’s why: The financial news is always negative at major bottoms — and positive at major tops.

Hence, many investors expect the negative news to lead to even lower prices, and positive news to lead to even higher prices.

Yet, the news is not an indicator of future prices — it’s a reflection of the past.

Put yourself on the right side of the stock market’s trend by learning what our Elliott wave analysts are saying.

Just follow the link below.