Canada’s real estate market is under pressure. Is the U.S. next in line?

Get ready for a big change in the U.S. housing market.

Our Elliott Wave Theorist explains how knowledge of Canada’s real estate market offers insight into what to expect for the U.S.:

There are approximately 101 million homes in America. According to Redfin, 24 million of them are owned as investments. Despite aggressive buying by institutional investors, 98% of homes bought for investment purposes are owned by individuals, often under the impression that renting out a house will be a lucrative business.

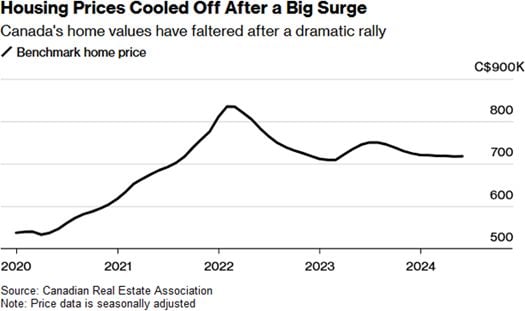

One day these people are going to realize that a home is not an investment. It is a deteriorating asset that takes continual expenditure to maintain. In Canada, the bloom is already off the rose (Bloomberg, Aug. 14):

Real estate coach mentorship programs were in demand during the Canadian housing boom. [They] promised to help small-time investors use property to build their personal wealth. Now, a backlash is brewing.

When home prices were surging and mortgage rates were low, it was more likely that rental income would cover mortgage payments and other costs. But higher borrowing costs, along with maintenance, taxes and other expenses, have upended that calculus.

The chart below shows that Canadian home prices peaked in early 2022. In America, prices are forming a double top. The experience of U.S. home investors is one cycle behind that of Canadian home investors.

I heard on the radio this morning that the U.S. has shifted from a sellers’ market to a buyers’ market. Has the wind shifted?

Also know that the housing market tends to be correlated with the stock market. Get timely insights by following the link below.