Example: Platinum’s December surge to 3-month highs was foreseeable through the lens of Elliott wave analysis. A story in charts continues below.

Every day, precious and industrial metals investors face a seeming conundrum: How do you prepare for events you can’t predict? After all, metal markets are supposed to be at the mercy of countless variables that are in constant flux.

From the standpoint of “market fundamentals,” the answer to that question says, follow those fluxing variables for clues as to where a market’s price may be headed. The only problem is that reading their predictions is like listening to Dr. Jekyll and Mr. Hyde sportscast a soccer game, swinging from extreme optimism to extreme pessimism and back again.

Take, for example, the recent “fundamentals”-based news stories surrounding the industrial metal platinum:

Extreme optimism: “Power cuts, war, and hybrid cars are predicted to cause a platinum price surge in 2023” — May 15 CNBC

Extreme pessimism: “Amplat sees no immediate rebound in low platinum metals price. Prices for platinum-group metals, which have declined rapidly over recent months, could remain depressed… ‘I really hope I am wrong but the way I am setting up the business is that those prices are in place for a bit of time,’ Miller said in an interview.” – Oct. 5 Reuters

Extreme optimism: “Platinum prices forecast: Set to explode as supply deficit widens” — Nov. 22 INvezz

Extreme optimism: “Platinum on Track for Record Deficit, Price Catalysts Building…I think the key point for this year is it’s very much a demand-led deficit.” — Nov. 28 Investing News Network

Extreme pessimism: “A further 10% decline in the platinum price could bring big trouble, warns CEO” — Dec. 11 News24

Extreme pessimism: “Platinum Miners Face Demand Downturn as EV Transition Revs Up” – Dec. 13 Wall Street Journal

And… extreme neutrality: “No news for platinum price “– Dec. 1 Economies.com

Fortunately, a different type of market analysis doesn’t obfuscate price trends; it can illuminate them.

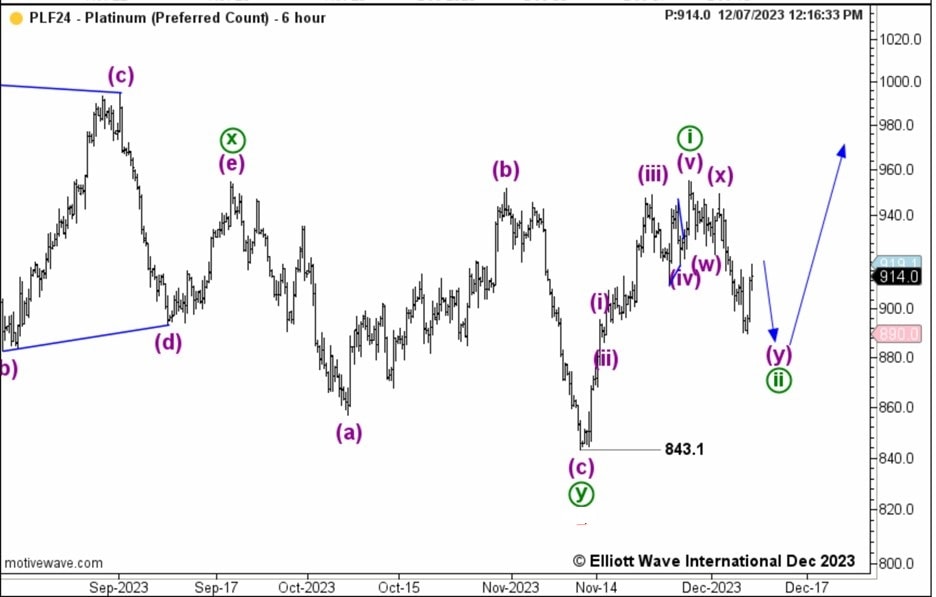

Case in point, on December 7, our Metals Pro Service assessed the Elliott wave pattern unfolding on platinum’s price chart. There, we placed prices at or near the end of a second wave pullback and thus, the start of a powerful third wave advance. From Metals Pro Service :

“The next move of note is scheduled as a five wave affair to the upside as green wave ((iii)) that projects to drive price well above 955.5.

“Shorter term at small wave degree and as long as price turns down soon from not much if any above 919.1, respect more than reasonable potential for price to soon turn lower in five waves to bottom at modestly under 890.”

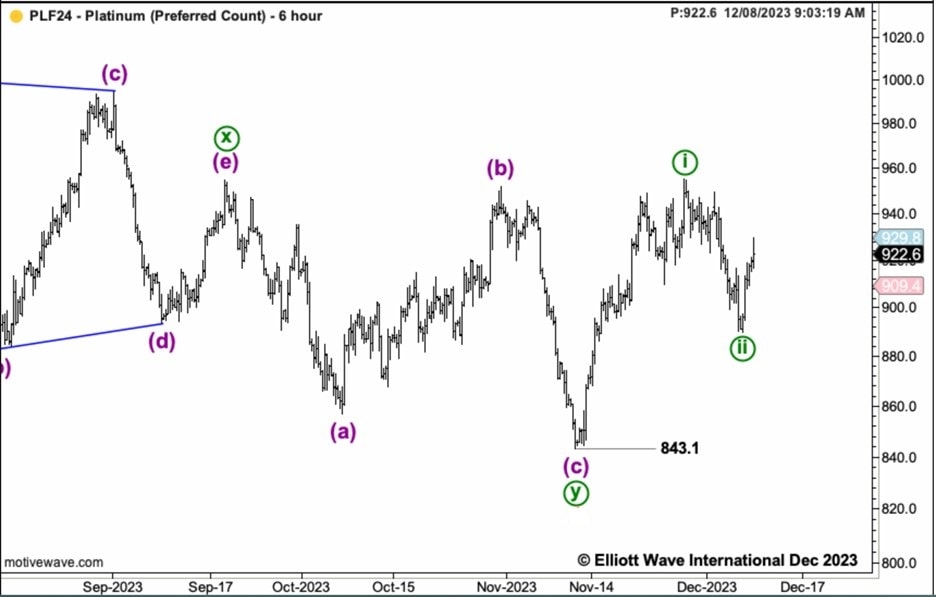

Platinum “decided” to skip that small initial sell-off and turned up in earnest, as the larger-degree Elliott wave count anticipated. So, on December 8, Metals Pro Service confirmed a bottom in place at 890 and the beginning of the anticipated third-wave advance.

And, from there, platinum continued to glitter, touching its loftiest level in 3-plus months on December 14.

And notice that not once did our Metals Pro Service mention the news or “market fundamentals.”

That’s because when you use Elliott wave analysis, that’s all you need.

Of course, no forecasting model is right 100% of the time, and Elliott wave analysis is no exception. However, even when Elliott wave projections don’t work out, the method allows you to calculate clear make-or-break support and resistance price levels that help manage the risk.

Precious Objectivity into Precious & Industrial Metals

Before the December rally in platinum, our Metals Pro Service was ready.

For active traders watching the intraday, daily and weekly movements, this service presents detailed analysis from intraday to longer time frames, focusing on meaningful developments underway in platinum, gold, silver – as well as copper, palladium, and more.

Let us help you go from following market trends to falling in line with their objective paths of least resistance.