At its most basic level, wave analysis is simply the identification of patterns in market prices.

The essential Elliott wave pattern consists of “motive waves” and “corrective waves.” A motive wave is composed of five subwaves. It moves in the same direction as the trend of the next larger size. A corrective wave is divided into three subwaves. It moves against the trend of the next larger size.

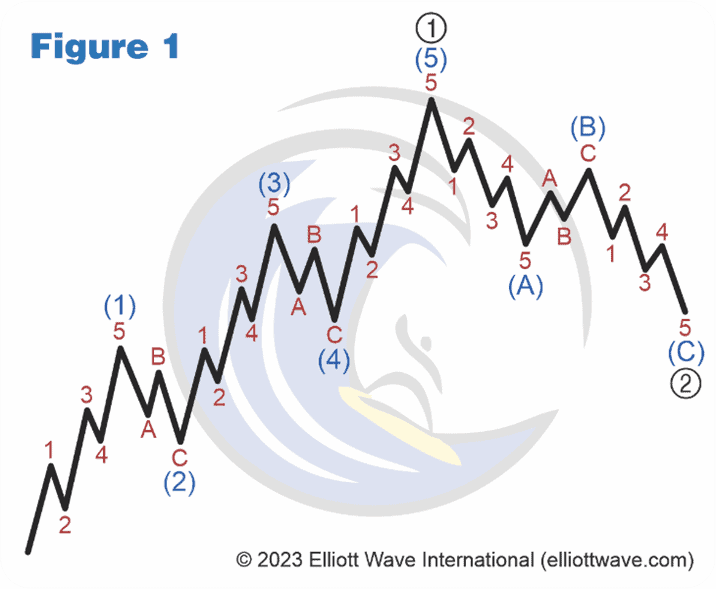

As Figure 1 shows, these basic patterns build to form five- and three-wave structures of increasingly larger size (larger “degree,” as Elliott said).

In the above illustration, waves 1, 2, 3, 4 and 5 together complete a larger motive wave sequence, labeled wave (1). The structure of wave (1) tells us that the movement at the next larger degree of trend is also upward. It also warns us to expect a three-wave correction — in this case, a downtrend. That correction, wave (2), is followed by waves (3), (4) and (5) to complete a sequence of the next larger degree, labeled as Wave 1 (circle). At that point, again, a three-wave correction of the same degree occurs, labeled as Wave 2 (circle).

Note that regardless of the size of the wave, each wave one peak leads to the same result — a wave two correction. That’s just a snapshot of how the Wave Principle can help you understand and anticipate market price action.

Learn the Essentials of the Elliott Wave Principle in 30 Minutes

Drawing directly from Frost and Prechter’s Wall Street bestseller, Elliott Wave Principle: Key to Market Behavior, this concise, user-friendly guide gives you the key principles you need to understand and apply Elliott waves.

You’ll learn:

- The 13 basic wave patterns that you’ll spot in all liquid markets

- Key rules and guidelines that help you fine tune your wave counting skills

- Common price and time relationships that allow you to project high-confidence price targets and retracement levels