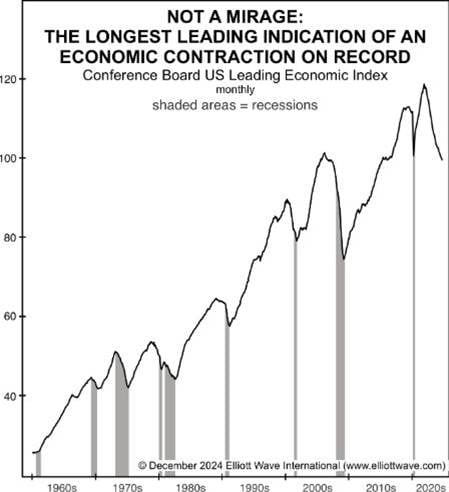

Is the U.S. economic contraction of 0.3% in Q1 a warning of what’s ahead? Well, even a month before the start of Q1, our December Elliott Wave Financial Forecast laid out data which spoke for itself – and the message still applies:

This chart below shows that the Conference Board’s Leading Economic Index (LEI) peaked in December 2021. The index has not had an uptick for 32 consecutive months, since February 2022. It’s now at its lowest level since March 2016. In the history of the data back to 1959, there has never been a turndown of this magnitude without an ensuing recession:

The current LEI decline is a Fibonacci 34 months old, starting at the December 2021 high. Prior to the current contraction, the longest LEI decline prior to a recession was a Fibonacci 21 months, from March 2006 to December 2007. It was followed by the steepest economic contraction since the Great Depression.

Mind you, at the time EWFF made the case to expect economic contraction, the consensus among economists was that the Fed had succeeded in raising interest rates just enough to curtail inflation but not inhibit economic growth. So much for the consensus. Instead of relying on “group think,” get more of our independent economic and financial analysis. It’s as easy as clicking on the button below.

If a recession (or worse) is ahead, you’ll want to get ready. Read our report, “Preparing for Difficult Times” – it’s FREE.