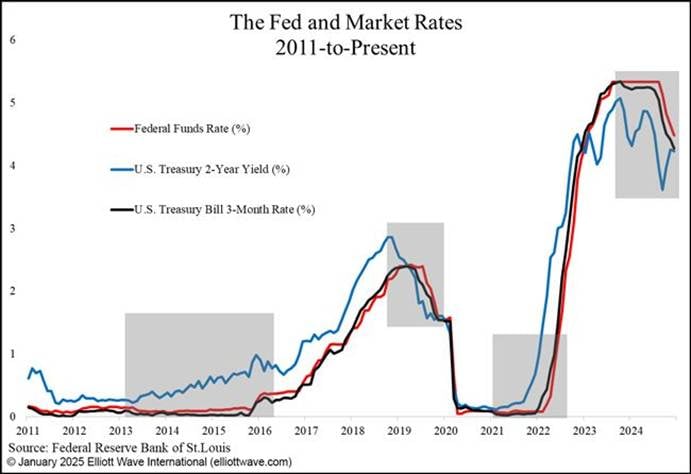

Rumors abound that a frustrated president is seeking a new Fed chair who will be more agreeable to lowering interest rates. But does the Fed chair REALLY have that power? As a historic case in point, on September 17, 2007, a CNBC interviewer asked Alan Greenspan, “Did you keep interest rates too low for too long in 2002-2003?” Greenspan instantly responded, “The market did.” It was a rare admission that the Fed may not be as omnipotent as people often think. To wit:

Since the Great Financial Crisis which ushered in the era of free money, the Fed’s penchant for being led by market pricing has become even more noticeable. This, despite the Fed’s perceived omnipotence becoming ever greater:

The 2-year yield had been rising since 2013 before the Fed raised rates in 2016, and had been falling from 2018 before the Fed cut in 2019, also led by the T-Bill rate.

After the COVID pandemic, the Jay Powell-led Fed abandoned the forward guidance policy, which actually made it obvious who was guiding who. Before the Fed started to hike rates in 2022, the money markets were screaming at the Fed to do something in the face of rising consumer price inflation. The 2-year yield had been rising since 2021. And before the latest round of Fed rate cuts, notice that both the 2-year yield and the T-Bill rate led the Fed’s decision.

So, what can we expect from the bond market next? Tap into insights when you read Global Rates & Money Flows by clicking on the button below.

Not ready to subscribe? Get more samples of our financial insights – FREE.