A few years back, many people thought that ultra-low interest rates were the norm. So, they were surprised when rates began to steadily rise.

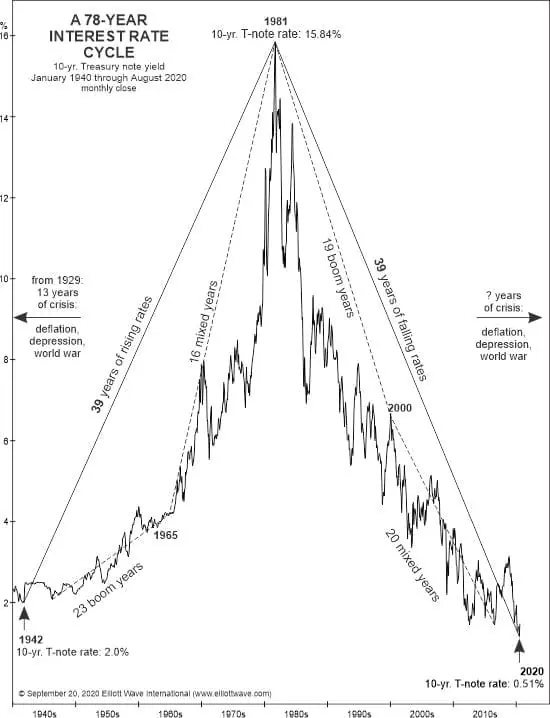

However, our October 2020 Elliott Wave Theorist did provide a warning with this chart and commentary:

The chart depicts a 78-year history of the interest rate on the U.S. government’s 10-year notes. The 39 years of rising interest rates from 1942 to 1981 preceded 39 years of falling rates from 1981 to 2020. … Interest rates likely bottomed in March, which means bond prices have begun a significant fall.

Of course, falling bond prices mean rising yields (and interest rates) and that’s the scenario which has played out as the October 2020 Theorist anticipated.

A lot of people who were in the market for a new home or car changed those plans because of the higher cost of borrowing.

Here in 2024, their hope has been that interest rates will go back down. Indeed, they’ve been encouraged by recent headlines like this (CNBC, March 21):

Here’s when the Federal Reserve could cut interest rates in 2024

Interest rate levels could fluctuate. No trend goes straight up or down. Yet, as Elliott Wave International has said many times, it’s the market which determines the trend of rates, not the Fed. The Fed merely follows the market.

Indeed, those hoping for a permanent return to historically low rates may be in for a big disappointment.

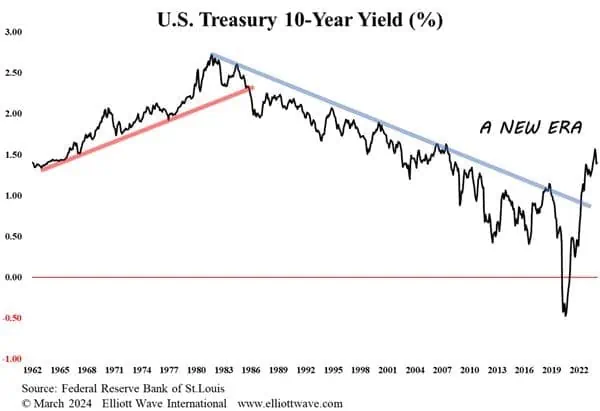

Global Rates & Money Flows is one of Elliott Wave International’s newest services and the March issue showed this chart and said:

The chart shows just how important the historic increase in bond yields has been by smashing through the four-decade-long downtrend in the bellwether U.S. Treasury 10-year yield. More than anything, this is a clue that we are now in a new era of elevated bond yields. In fact, the uptrend in yields is probably only getting started.

Get more financial insights from Global Rates & Money Flows by following the link below.

Learn About the “New Era” in Interest Rates

Why rates may be headed even higher

Many people are hoping for a return to historically low interest rates. Yet, a “new era” of higher rates may have only just started. These two charts help to provide insight.