“Negative readings on this indicator foreshadowed all three of the most recent recessions”

Ironically, just before Labor Day, which honors the nation’s workers and their contributions to the country, we had this headline (The Daily Caller, Aug. 30):

US Job Growth Drops Sharply, Signaling Worrying Trend For American Economy

Private employment growth dropped significantly from 371,000 private jobs in July to 177,000 in August …

In addition, we had this Aug. 31 news item (Reuters):

US layoffs surged in August — report

U.S.-based employers announced 75,151 job cuts in August, according to a report released on Thursday by employment firm Challenger, Gray & Christmas, a 217% surge from July’s levels, which were the lowest in nearly a year.

This is not surprising to Elliott Wave Financial Forecast subscribers.

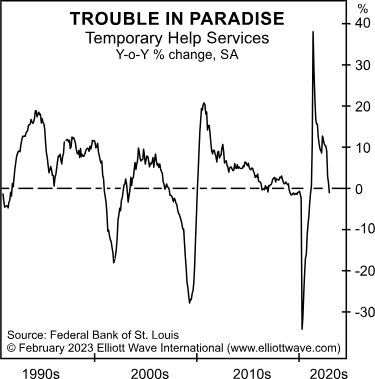

As far back as February, this monthly publication described warning signs for the U.S. jobs picture. Here’s a chart and commentary from that time:

The hiring of temporary help, the front line of the labor market, already reflects this potential [for an employment crisis]. The steep decline shown on this chart is the year-over-year change in temp help hiring. In December, the yearly change went negative for the first time since the aftermath of the recession of 2020. Negative readings on this indicator foreshadowed all three of the most recent recessions. There was one false signal, a brief negative reading in 2016.

Looking ahead from this juncture, here in early September, those who have a “good” job may want to hang on for dear life. Job hoppers may find themselves without a chair in which to sit once the music stops.

Of course, one of the most famous times in U.S. history when the music stopped (the financial and economic “music,” at least) was in 1929. And just know that Elliott Wave International sees signs which indicate that we may be entering a comparable financial and economic phase.

With that in mind, consider this quote from Robert Prechter’s Last Chance to Conquer the Crash:

In 1929, the party was on, and few people envisioned a reversal. Just three years later, banks were failing across the country and unemployment was pushing 25% in the deepest depression since the late 1700s. [emphasis added]

Get our latest economic analysis by following the link below.

The Stock Market Always Finds a Way

To Fool Investors at Crucial Junctures:

It has happened again and again throughout stock market history.

Why? Because the patterns of investor psychology never change.

Please know that Elliott waves show you these patterns. So, knowledge of our current Elliott wave analysis of the equity market can help put you on the right side of trend changes.

Our Financial Forecast Service offers in-depth analysis of the U.S. stock market, as well as bonds, gold, silver, the U.S. Dollar and more.

Get details about our main investor package by following the link below.