In his landmark book, the Socionomic Theory of Finance, Elliott Wave International’s founder Robert Prechter reveals 13 market myths which harm investors.

Most investors accept these ideas as true, but they fool investors into making unwise decisions. You can read them all by following the link below.

Right now, I want to go ahead and discuss one of those myths, which has to do with the claim that targeted central bank buying and selling moves markets.

For example, most economists and investors would probably agree that if central banks bought billions of dollars of gold, the price should soar. And, conversely, heavy selling would cause the price of gold to fall.

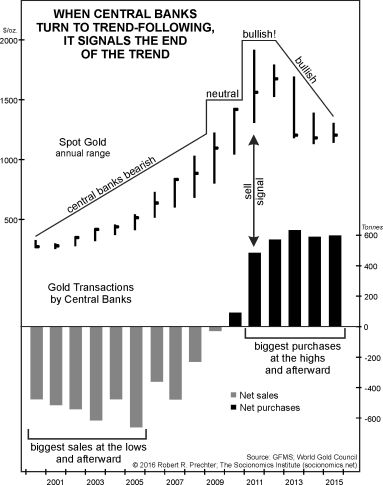

However, Robert Prechter shows what happened with this chart and commentary:

Despite the huge and theoretically unlimited buying power of governments’ money-creating monopolies, their buying and selling of gold has in fact been inversely related to the metal’s price trend. Central banks’ persistent selling of gold from 2000 through 2009 occurred as the metal rose five times in value; their neutral stance of 2009-2010 saw gold double; their rush to buy in 2011 caught the top of the market; and their persistent buying has continued throughout the bear market to date [as of April 2015.]

In Chapter 2 of the Socionomic Theory of Finance, Robert Prechter offers an explanation:

[Central bankers] act as naïve odd-lotters, who fight a trend until it ends and then join it.

So central bankers are usually not very good market timers. Sure, there are times when their buying and selling actions are in sync with the market, but often, they buy when they should be selling and sell when they should be buying. In other words, central bankers usually behave just like most of the rest of the investment crowd.

The bottom line is that the common-sense conviction that massive central-bank buying or selling of an investment item would make its price rise and fall is wrong.

This is only one of the 13 market myths that you will find as you access Chapters 1 and 2 of the Socionomic Theory of Finance by following the link below.

It’s True: Central Bankers Fight a Trend Until It Ends — And THEN Join It

Targeted central bank buying or selling does NOT move markets

Does heavy buying or selling of an investment item by central banks make the price of that asset rise or fall? You might be surprised. This chart and commentary from the Socionomic Theory of Finance is eye-opening.