“The highest commitment to stocks since the record levels of early 2000”

We all love Mom and Pop and cherish the valuable lessons about life they’ve given us along the way.

Yet, when it comes to investing, Mom and Pop may need to learn some lessons of their own.

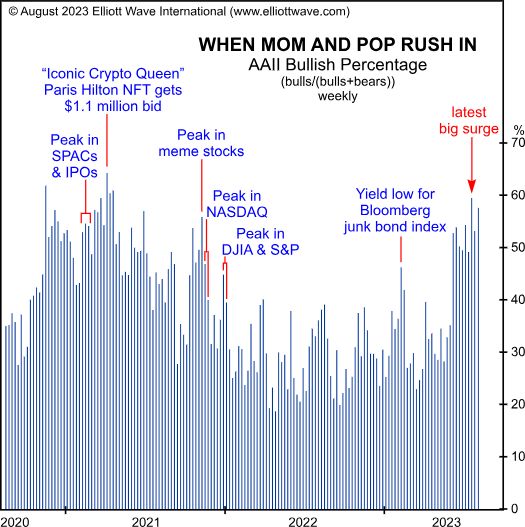

Keep in mind that the American Association of Individual Investors’ (AAII) weekly survey is said to be representative of “Mom and Pop” investors, well-known for being quite cautious.

Our August 2021 Elliott Wave Financial Forecast discussed their behavior as the stock market was staging a significant rally:

In July [2021], the five-month average AAII stock allocation increased to 70.6%, a high level for this normally skittish cohort of investors… This is the highest commitment to stocks since the record levels of early 2000.

This sentiment indicator is not meant for precision market timing, and, indeed, it seemed like these normally cautious investors had made the right decision. The rally persisted for the remainder of 2021. But, by early January 2022, the Dow Industrials and S&P 500 hit their all-time highs and have traded lower since.

What does this have to do with today?

Here’s an interesting chart and commentary from our August 2023 Elliott Wave Financial Forecast:

This chart shows a jump in the AAII bullish percentage to 59.5% on July 21… These mom-and-pop investors are traditionally cautious, so big moves and extreme readings generally reflect important capitulations.

Let me emphasize again that sentiment indicators are important yet you may not want to use them for market timing.

That said, when you combine time-tested sentiment indicators with Elliott wave analysis, you get a much clearer picture.

You can access our latest Elliott wave analysis of the U.S. stock market by following the link below.

3 Pillars of Stock Market Forecasting:

Patterns, Momentum, Sentiment

Discover what our stock market analysis reveals about these three pillars for the remainder of 2023, via our Financial Forecast Service.

You also get our outlook on bonds, gold, silver, the U.S. Dollar, the U.S. economy and much more.

Also know that our forecasts include setting key price targets for key financial markets.

Learn more about our Financial Forecast Service by following the link below.