Here’s what happened with stocks for five-months as jobless rate worsened

In his landmark book, The Socionomic Theory of Finance, Robert Prechter calls attention to 13 market myths which can harm investors.

Many investors accept these claims as true, but they mislead investors into making decisions which can damage their portfolios. You can read them all for free by following the link below.

Let me go ahead and show you one of these myths, which has to do with jobs reports and the stock market.

Simply put, many investors believe that a glowing jobs report has a great chance of sending stock market prices higher and – you guessed it – disappointing jobs figures may very well cause stock prices to tank.

These investors have been conditioned to think this way by headlines like these:

Dow Industrials Post Triple-Digit Gain on Better-Than-Expected Jobs Data

Or –

S&P 500 Sinks as U.S. Unemployment Rate Rises

But who can forget the 2007-2009 financial crisis? During the darkest days, the employment picture was bleak. The jobless rate had worsened for 15 straight months. Yet, during the last five months of that worsening 15 month stretch, the stock market rallied.

Here’s what Robert Prechter had to say about that in The Socionomic Theory of Finance:

During the rally from March through July 2009, there were no headlines that read, ‘Rising Unemployment Rate Sends Stocks Higher,” because such a statement would have made no sense. Analysts simply sought out other news to explain the market’s action.

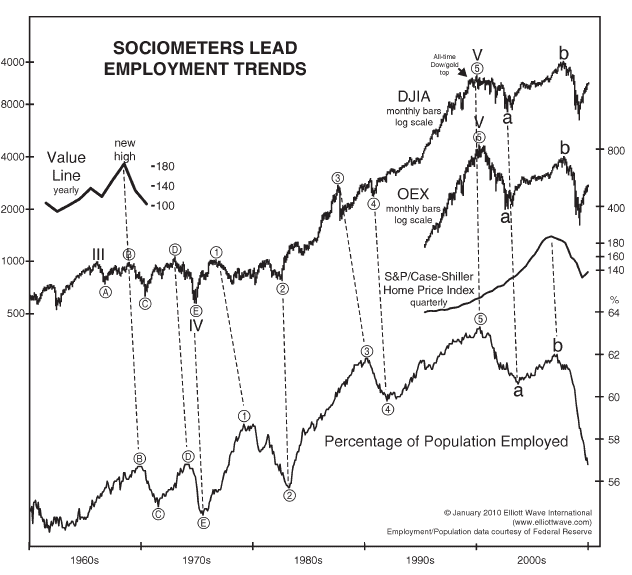

Indeed, you may be interested in knowing that trends in employment generally follow the action of the stock market, not precede it – as this chart and commentary from the book make clear:

According to the history displayed on this chart, if you were to lag your forecasts for employment trends by one to three years at stock market tops of at least Primary degree and by three to eight months of commensurate stock market bottoms, you would be mostly right on both the trends and the turns.

Remember, this is only one of the 13 market myths that you will find as you access Chapters 1 and 2 of The Socionomic Theory of Finance for free by following the link below.

13 Market Myths That Mislead Investors

Learn What They Are in The Socionomic Theory of Finance

- Positive corporate earnings “cause” the stock market to rally.

- Higher bond yields “cause” stocks to drop.

- Inflation “causes” gold and silver prices to rise.

Many investors hear these claims so often that …

… They assume them to be irrefutably true. So, instead of challenging the claims and assumptions, they instead invest untold mountains of money.

But know that Robert Prechter’s extensive research reveals that many widely held beliefs about what drives the stock market do not stand up under scrutiny.

In his groundbreaking text, The Socionomic Theory of Finance, Prechter digs into financial history to expose the most popular cause-and-effect market myths touted by economists, news outlets and brokers.

Read the first two chapters now for free and discover 13 dangerous investor myths.