Elliott wave channeling can help you identify price targets and realize how future trends could develop.

A properly drawn channel typically marks the upper and lower boundaries of an impulse wave (a five-wave move in the direction of the trend). Elliott channels are most useful in identifying targets for wave four and five.

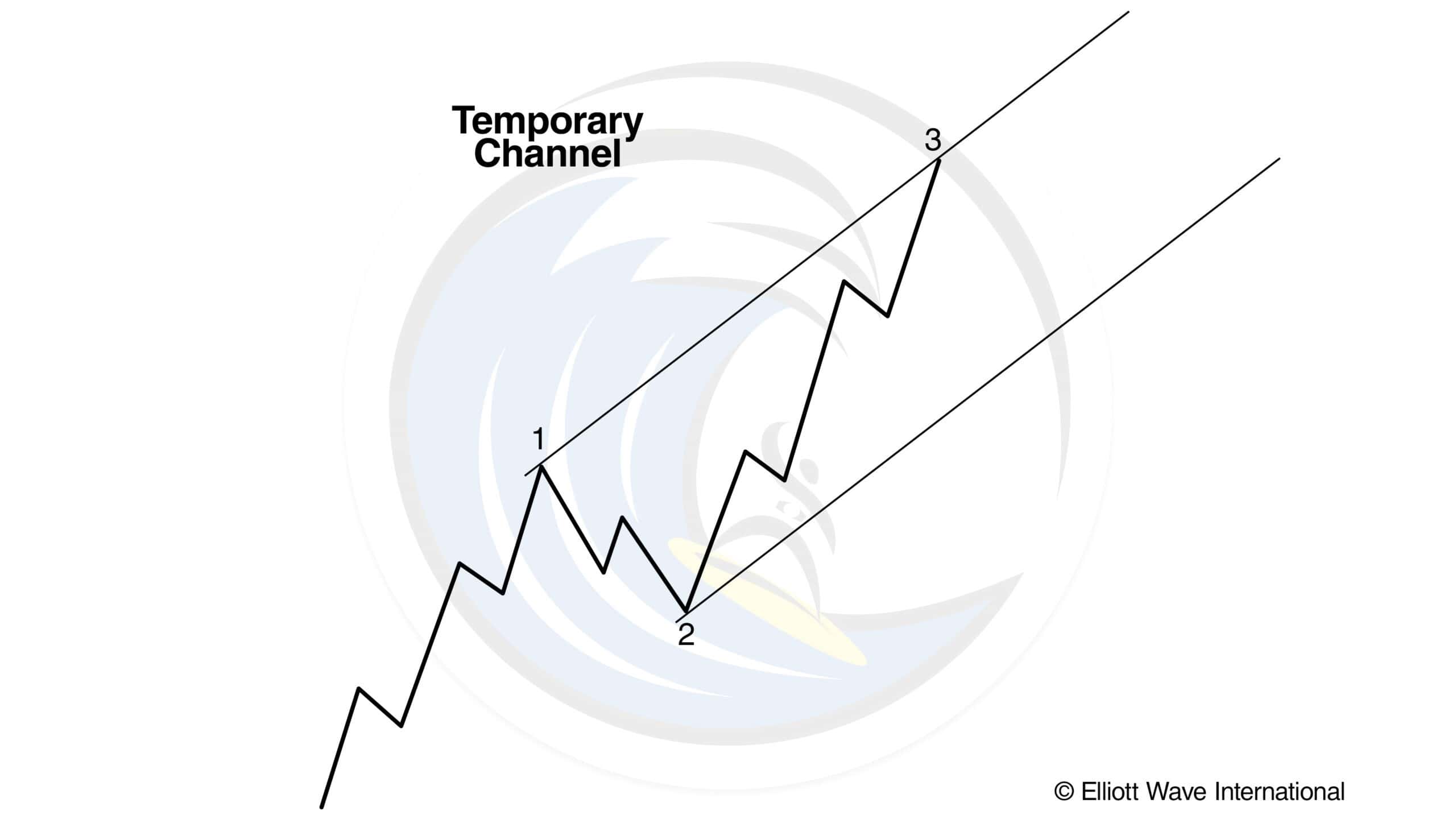

The initial channeling technique for an impulse requires at least three reference points. When wave three ends, connect the points labeled 1 and 3, then draw a parallel line touching the point labeled 2, as shown below.

This construction provides an estimated boundary for wave four. (In most cases, third waves travel far enough that the starting point is excluded from the final channel’s touch points.)

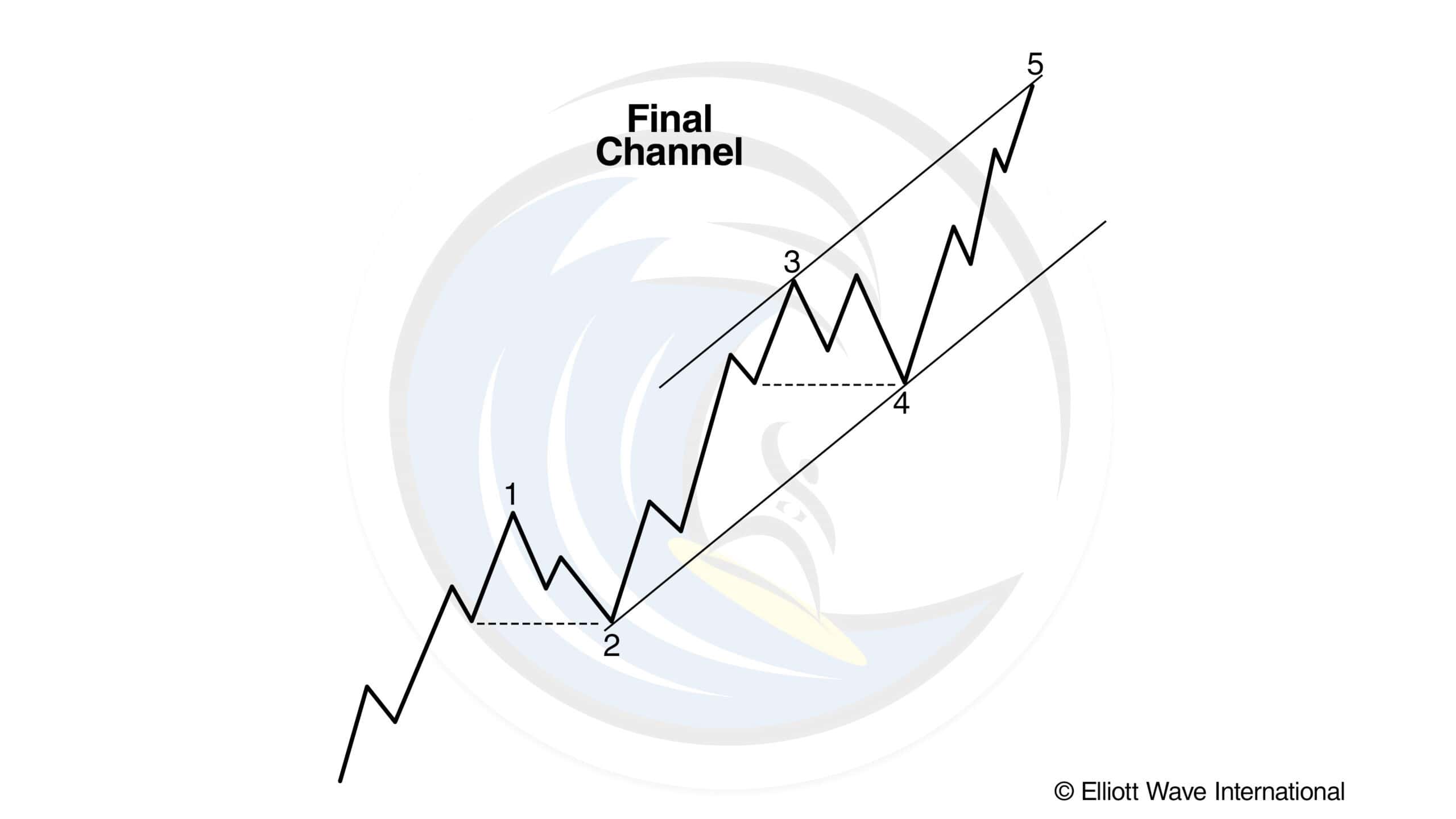

If the fourth wave ends at a point not touching the parallel, you must reconstruct the channel in order to estimate the boundary for wave five. First connect the ends of waves two and four. If waves one and three are normal, the upper parallel most accurately forecasts the end of wave five when drawn touching the peak of wave three, as in the chart below.

Pro tip: If wave three is abnormally strong, almost vertical, then a parallel drawn from its top may be too high. Experience has shown that a parallel to the baseline that touches the top of wave one is then more useful. In some cases, it may be useful to draw both potential upper boundary lines to alert you to be especially attentive to the wave count and volume characteristics at those levels and then take appropriate action as the wave count warrants.

Try Trader’s Classroom for only $1 per day

For a limited time, $30 gives you 30 days of access to Trader’s Classroom — a trusted service for traders looking to elevate their skills.

In a recent lesson, veteran instructor Favio Poci shows you step-by-step how he applies Elliott wave channels in real time. His latest class is waiting for you inside.