“The stock crashed another 25% over just seven trading days”

Given the recent sell-off in global financial markets, a lot of investors are wondering if they should “buy the dip.”

Indeed, on Aug. 5, the date that the Dow Industrials cratered more than a 1,000 points and Japan’s stock market posted its worst drop since 1987, Reuters had this headline:

Global stock traders face dip-buying dilemma after crushing selloff

It’s a dilemma because “buy the dip” can work out — until it doesn’t. A stock or index which has plummeted can plummet even more.

Our August Global Market Perspective provides a case in point with this chart along with a brief quote:

Despite Burberry’s 14-month, 68% swoon since April 2023, the stock crashed another 25% over just seven trading days in July.

Sticking with luxury goods, the stock of Hugo Boss peaked at a countertrend high in July 2023. The stock fell 50% in 11 months and still declined 11% on July 15.

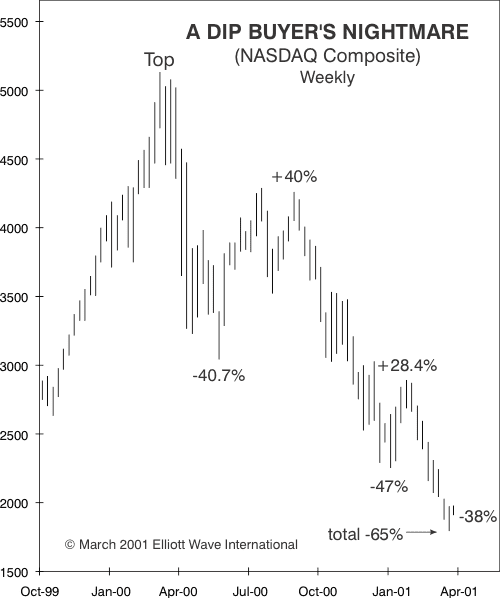

A historical illustration of dip buying going horribly wrong is from our April 2001 Global Market Perspective:

Anyone who bought into the euphoria at the all-time high or the bull trap highs of early September and late January, would have taken successive hits of 40%, 47% and 38%. You can bet that many people followed the “buy” advice in the media on every bounce, losing even more than the “hold-only” loss of 65% from top to bottom.

Getting back to 2024, no one knows if current dip buyers will be rewarded or experience their own nightmare.

However, we can give you our assessment of major global financial markets. We believe that you can benefit from our decades-long experience at “fractal market forecasting” – or analyzing repetitive chart patterns to anticipate what’s next.

Learn how you can tap into the insights of our August Global Market Perspective by following the link below.

Read Our August Global Market Perspective

Learn How Investor Psychology is at Work in 50-Plus Worldwide Financial Markets – Now

Our monthly Global Market Perspective offers a deep dive into global stock indexes, interesting individual stock opportunities, bonds, metals, crude oil, natural gas, cryptocurrencies, forex and more.

As one subscriber says:

“I read GMP cover to cover the weekend it arrives. The insight into what is going on around the world gives me so much perspective.”

You get 60-plus pages of analysis and forecasts which includes coverage of the U.S., Europe, the Asian-Pacific and more.

Learn how you can access our August issue of the Global Market Perspective by following the link below.