If there were such a bumper sticker, the honking on a busy stretch of freeway would be deafening. That’s not hyperbole. Get this: One in four new-vehicle buyers were underwater on their trade-in car loans in the October to December 2024 timeframe, according to Edmunds. On top of that, the average amount owed was higher than ever – more than $10,000. Our Elliott Wave Financial Forecast had its pedal to the metal with this story back in March:

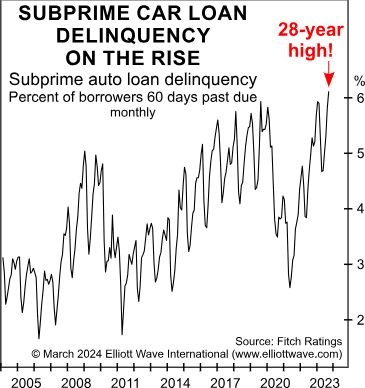

Sub-prime car loan delinquencies are even higher than they were in the wake of the Great Recession in 2007-2009 (see chart below):

In fact, car loan delinquencies are higher than at any time in the data’s history, which goes back to 1996. According to Cox Automotive, access to auto credit is the lowest in nearly four years. Defaults on debt instruments of every stripe are at the heart of the unfolding global economic contraction. According to the Brookings Institute, the U.S. “almost single-handedly staved off a global recession” in 2023. But delinquencies in the car-loan and credit-card markets, as well as commercial real estate foreclosures, reveal that the U.S. is on weaker ground than almost every economist thinks.

Prepare for the arrival of “Peak Auto.” If you’re unfamiliar with the phrase,” check out our January Elliott Wave Financial Forecast now.

Want more market insights like this? Sign up to get them sent straight to your inbox – FREE.