Letting you know upfront, the analysis featured in this video is from EWI’s new, April 2024 Global Market Perspective. You can read the entire issue in our State of the Global Markets event, now in progress. Look for the link below the video for instant access to Global Market Perspective when you join our Club EWI for $2 a month. (Not a typo. Just $2/mo.)

In the U.S., quite a few market pundits are convinced that the stock market has a lot more to go on the upside.

Even some of the bears have capitulated to the bullish sentiment as reflected by this March 4 Bloomberg headline:

Even [an] Uber-Bear Is Upbeat …

Along the same lines, many money managers are so bullish that they’re “all in” – and more. By “more,” I’m referencing their use of leverage.

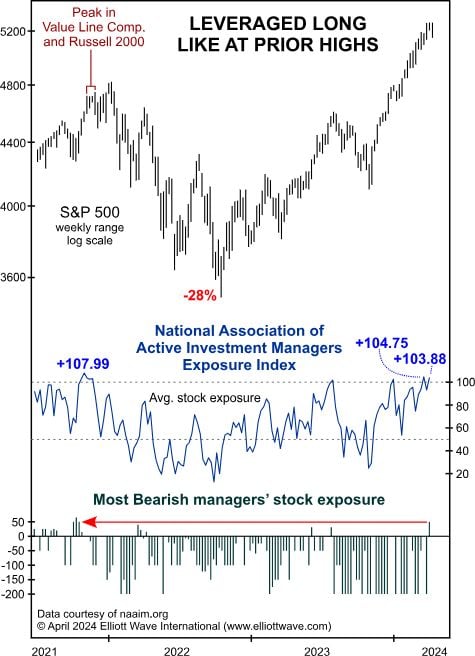

Keep in mind as you review this chart and commentary from our April Global Market Perspective, readings above 100 mean that the average manager is leveraged long in anticipation of higher equity prices:

During the weeks of March 13 and March 27, the National Association of Active Investment Managers’ Exposure Index pushed to 104.75 and 103.88, respectively, the most extreme readings since November 2021. This is when the Russell 2000, Value Line Composite and Dow Transports all recorded their all-time highs. The NASDAQ Composite topped two and a half weeks later and started a 38% decline to October 2022. The bottom graph shows another remarkable development: a clear capitulation on the part of the most bearish fund managers. The week of March 27, the exposure of the “most bearish managers” flipped from a fully negative -200 to a strongly positive +50.

The implication is clear: When nearly everyone has taken the same investment position, there’s hardly anyone left to join. You’ve probably noticed that stocks have had quite a rough month so far, which is probably not a coincidence.

The Elliott wave analysis we provide in the new, April Global Market Perspective will give you an even fuller picture – and not just for the U.S. markets, but for over 50 markets around the world.

Indeed, you can see fully labeled charts and complete analysis inside EWI’s State of the Global Markets event, which is on now through May 3rd. You get full access to the latest issue of the Global Market Perspective and a host of practical Elliott wave resources.

The event is free to EWI subscribers and Club EWI members. You can join Club EWI and take part in this event for only $2 by following the link below.

Here’s What Happened Last Time Investment Managers Were This Bullish

The National Association of Active Investment Managers’ Exposure Index is bumping up at the 2021 high…

Watch out when nearly every money manager positions themselves on the same side of a market trend – and does so with leverage. Here are insights into what many active investment managers have been doing with their portfolios – and why every investor should be interested.