Elliott Wave International’s Financial Forecast Service Test Drive event is on now. You get access to our flagship analysis for a week for only $27. Follow the link below to take advantage of this rare opportunity.

I’d like to go ahead and share an insight from the May Elliott Wave Financial Forecast, which is part of this event, by starting off with this question: Did you know that global hedge funds and other alternative-asset funds hold more assets under management than banks?

They do. Many people who have been around financial markets a good while know that hedge funds are big, but perhaps did not realize they were that big.

As an April 24 Wall Street Journal headline said:

Move Aside, Big Banks: Giant Funds Now Rule Wall Street

Indeed, hedge funds hold twice as many assets under management compared to banks – even though many investors in hedge funds must wait through a “lock up” period before they can make withdrawals. Those lock up periods can last anywhere from one month to ten years.

People who are willing to agree to such terms are obviously displaying a high degree of faith in a fund.

Yet, we here at Elliott Wave International have our own perspective. Here’s a chart and commentary from our May Elliott Wave Financial Forecast:

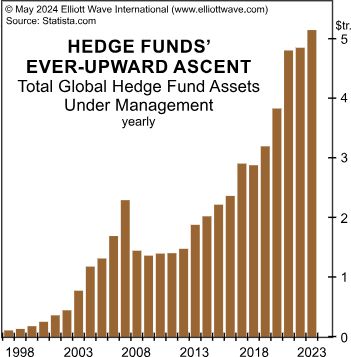

Over the course of the last 26 years, global hedge fund assets under management went up every year except for two years during the Great Credit Crisis and in 2018, which followed a third wave peak in stocks. In the Journal’s April 24 article, fund managers “insist the expansion remains in its early innings.” What could go wrong?

In a nutshell: a lot! First, keep in mind that banks consolidated in the years just prior to the financial crisis of about 15 years ago. Now, hedge funds are doing the same.

A second reason why things could go wrong with hedge funds is summed up by that previously mentioned Wall Street Journal article (April 24):

The firms are becoming more complex and more similar to one another all at once.

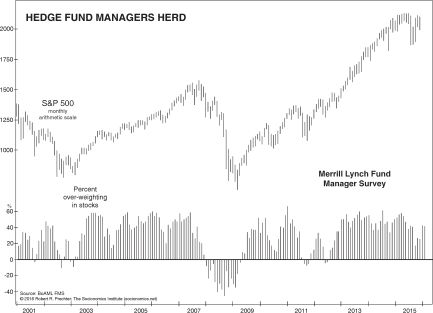

That sounds like the “herding” mentality referenced in Robert Prechter’s landmark book, The Socionomic Theory of Finance. Here’s a chart and commentary:

It is widely known that professional money managers, in the aggregate, fail to beat the market. The result is not, as some theorists say, because the market moves randomly. It is because most professionals are herding, right along with other speculators.

Remember, the “crowd,” which includes individual and professional investors alike, is almost always on the wrong side of financial markets at big turns.

Get our take on where U.S. stocks, bonds, gold, silver and the U.S. Dollar are headed by joining our Financial Forecast Service Test Drive event – which is in progress for a very limited time.

Follow the link below to learn more now.

Hedge Funds Dominate Wall Street: What Could Go Wrong? (Video)

Perspective on hedge funds’ “ever upward ascent”

Groupthink pervades all subsets of financial market participants – individual investors, financial advisors, corporate insiders, hedge fund managers and others. Let’s focus on one of these subsets – hedge fund managers. You might be surprised by what you learn.