Gold’s bullish run since 2022 makes no “fundamental” sense. But it’s exactly what the Elliott wave outlook called for – back in October 2022

How now yellow metal!? On March 8, 2024, gold prices catapulted above $2200 (intraday) per ounce to strike a lifetime high. That’s going back 40-plus years since the start of gold trading.

For “Fedheads”—i.e. investors who use Federal Reserve monetary policy decisions and inflation figures to gauge the future of precious metals – gold’s bull run is a bit of a head-scratcher. The reason being, according to economics 101, rising interest rates are bearish for gold as they reduce the opportunity cost of holding the metal, which earns no interest.

And yet, the gold bull run since late 2022 started right alongside one of the most hawkish Fed’s in all central bank history.

To refresh one’s memory, let’s go back to September-October 2022. At the time, gold prices had plummeted 20% to enter official bear-market territory. And, according to the mainstream experts, the cause for gold’s weakness was a very vocal Federal Reserve publicly hellbent on crushing a post-pandemic case of runaway inflation via rate hikes. Here, these headlines from the time set the scene:

- “Gold Slides as Hotter US Inflation Keeps Hawkish Fed on Track” — Sept. 12 Bloomberg

- “US Inflation Shock Sees Gold Prices ‘Limited’ by Surging Fed Rate Bets” — Sept. 14 Bullion Vault

- “Gold price drops to two-year low with Fed rate hike in focus” — Sept. 22 Mining.com

From CNN Business on September 23:

Call it the Fed effect. The central bank has been aggressively hiking interest rates in a bid to bring down inflation, which remains stubbornly high…

The Federal Reserve increased rates on Wednesday by three-quarters of a percentage point for its third consecutive meeting, an unprecedented move. It also signaled that significant hikes could be on the table in November and December. Those movements have been hurting stocks. But they’re also affecting gold.

CNN concluded: Gold is “unlikely to stage a comeback” while the Fed continues its rate-hike trigger-happy campaign.

And – the Fed didn’t stop hiking rates. Between March 2022 and July 2023, it raised rates 11 times from .25% to 5.5%. Yet gold… it began climbing in October 2022 and has continued doing so, striking an all-time high in March 2024.

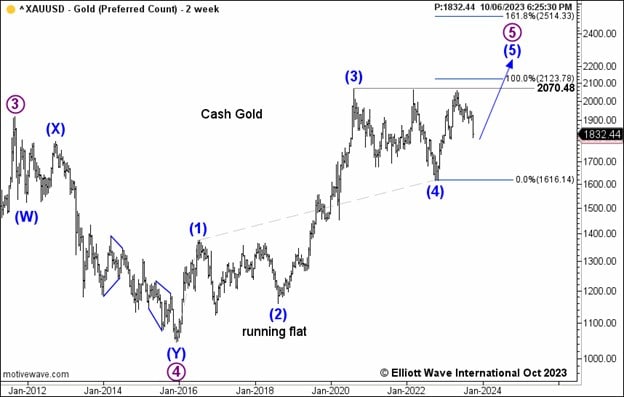

The fact is, gold’s bullish comeback has nothing to do with the Fed, rate hiking or holding. It began in October 2022, when a bullish Elliott wave set-up unfolded in gold prices. Here, on October 28, 2022, our Metals Pro Service presented this long-term chart of gold which showed a fourth-wave flat correction as complete. The next long-term move of consequence would be a fifth wave rally to “new all-time highs.” From Metals Pro Service on October 28, 2022:

Gold appears may be near completing wave (4) as a flat correction at 1618.30. The sharp rise boosts confidence that wave (5) is on its way to new all-time highs

From there, even as the Fed continued to boost rates, gold’s bullish Elliott fifth wave took off. Once again, nearly a year later, another fourth wave pullback appeared to be complete on gold’s price chart. On October 6, 2023 Metals Pro Service showed this newly updated wave count, which called for the resumption of the fifth wave rally:

Gold probably completed wave (4) as a flat correction at 1616.14. The sharp rise boosts confidence that wave (5) is on its way to new all-time highs in the 2123.78 area and potentially much higher.

With gold prices crossing the $2200 per ounce historic threshold, the reigning question is: how high is gold set to fly?

The answer to that question won’t be found in the Fed’s next minutes meeting. It will, however, be found in our premier Metals Pro Service intraday, daily, and weekly updates.

Golden Opportunities in Global Metals Markets

Right now, our Metals Pro Service takes you from passive observer to armored participant. This means, you’ll learn how to recognize specific price patterns that show the trend and a price target; or a correction that’s about to end; or the vital support and resistance levels for risk management.

Ready to see where the next opportunity could be in not only palladium, but also gold, silver, platinum, copper and more?

Then look below for the quick, instant-access steps to add our premier Metals Pro Service to your trading toolkit.