The price advance in gold has been broad, meaning that new all-time highs have not only been reached in U.S. dollars, but in several other currencies as well.

Yet, around the start of the year, the outlook for gold was bleak, according to this Jan. 5 headline (Reuters):

Gold set for weekly decline as dollar, yields climb

The rally in gold which started in early October continued to struggle for much of the rest of January.

Indeed, even in the first half of March, opinions about gold continued to be negative, as reflected by these headlines:

- Why Gold No Longer Shines As A Long-Term Investment (Seeking Alpha, March 5)

- Goodbye, Gold Price Rally – Here’s What’s Next (investing.com, March 12)

However, around the time this negative sentiment was expressed about gold, our March Global Market Perspective offered this analysis:

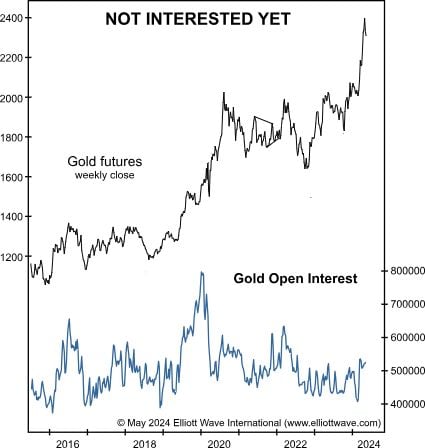

The low level of open interest means that investors’ attention is turning away from gold, and the low implied volatility indicates that investors do not expect gold to move much over the course of the next three months. Both are preludes to what we see as a major move forming in gold prices.

The progressing wave structure indicates that gold’s larger rally has more to go.

Indeed, gold’s rally did continue. By April 12, the yellow metal hit an intraday extreme at $2431.03, and as I’m sure you’re aware, there’s been volatility since.

Here are insights about gold from our May Global Market Perspective, along with a chart:

Open interest, the total number of outstanding gold futures contracts that have not been settled, is still relatively subdued when compared to conditions during prior advancing waves. In other words, despite new all-time highs, investors have yet to turn their full attention to the gold market.

Our May Global Market Perspective goes on to discuss what usually happens during major bull markets in commodities and how that relates to the Elliott Wave Principle.

Indeed, the publication mentions a specific price level to watch and explains why.

Get our detailed analysis of gold, as well as silver, by reading our Global Market Perspective. Get started by following the link below.

Gold: How to Gauge Investors’ Level of Interest (Video)

Here’s how recent “open interest” compares with prior gold rallies

Investors the world over are wondering if gold’s rally has any more steam. Let’s examine recent Gold Open Interest and how that compares with prior price advances.