The key to unlocking cattle’s bullish comeback was in investors’ hands all along. They just tried the wrong lock. This time could be different.

This weekend I discovered one of the most visually stunning and emotionally gripping nature documentaries I’ve ever seen. (And I’ve been watching these kinda shows since Wild America aired on PBS in the 80’s!).

But Our Planet on Netflix takes the genre to an entirely new level of strikingly clear drone footage (It’s like you can feel the whiskers of a yawning African lion napping with its cubs). And for the first time ever, the series captures never-seen-before assemblies of animals along their seasonal migratory paths; paths blazed millions of years ago by the animals’ original descendants.

Their courses, thousands of kilometers long, are stored like saved GPS locations in their collective memory, guiding them back and back again to the lands most optimal to breed.

But sadly, while these courses have stayed the same, the conditions along them have been irrevocably altered by a changing climate and human development. Snow geese, once fed by the lush grasslands along their winter migratory routes from sub-Arctic North America to the Northeastern United States now find those same regions barren and drought stricken. In turn, the paths once supportive of their survival, are now causing their demise. And to change them, as seems necessary, would be to alter many a millennium of instinctual homing hardwiring.

It reminds me of the ancient hardwiring of mainstream financial analysis, which has taught traders and investors of yore to follow the long-whittled “fundamental” path for trend navigation. Namely, look to news events outside of markets to gauge future price trends.

But like the now perilous migratory paths of animals, this timeworn course may cause more harm than good.

Take, for example, the live cattle market. Starting in early 2020, the US livestock market was slated to be a foregone casualty of the global pandemic. Live cattle prices circled the drain of a decade low, and an entirely new word was created to describe the widely expected decline of farm-raised beef prices: the “Cowvid” Crisis. (Jan. 15, 2021 HistoryColoroda.org)

These 2020 news items from the time feed the bearish flames:

- “Live Cattle Futures Plunge as Pandemic Roils Markets” (April 6 Reuters)

- “US Cattle Futures Hit 10-Year Lows as Coronavirus Stokes Demand Uncertainty” (March 17 Farming Independent)

- “Coronavirus Sends Crop and Livestock Prices into a Tailspin” (April 7 FB.org)

Following the “fundamental” course meant migrating south to the most optimal breeding ground for opportunity.

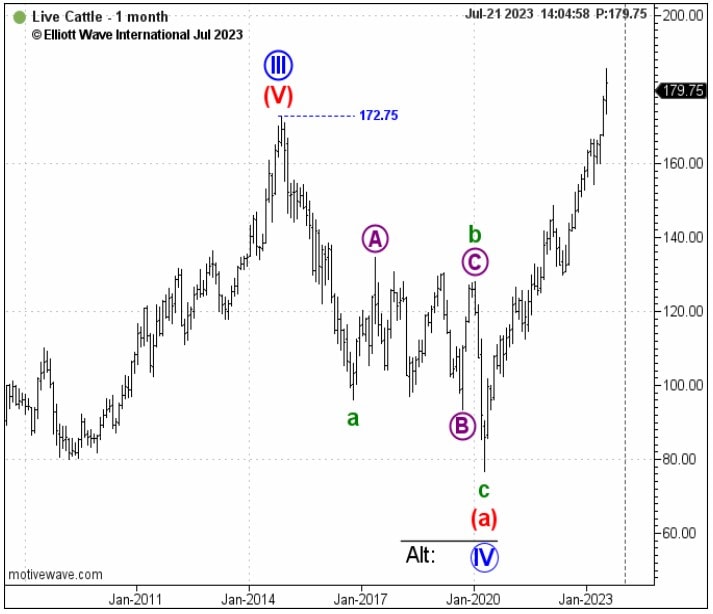

And yet, after bottoming in May 2020, live cattle prices veered straight off their “fundamental” course and launched into a 3-year long rally to record highs in July 2023. Here, the hardwiring of news-driven markets was antithetical to financial progress.

Which begs the question: Isn’t this proof that markets, are, in fact random, as so many investors puzzled by similar occurrences believe?

Not at all. It’s proof that the “fundamental” model of market analysis is misdirected. News is not the driving force of price trends. Investor psychology, which unfolds as Elliott wave patterns directly on price charts themselves, is.

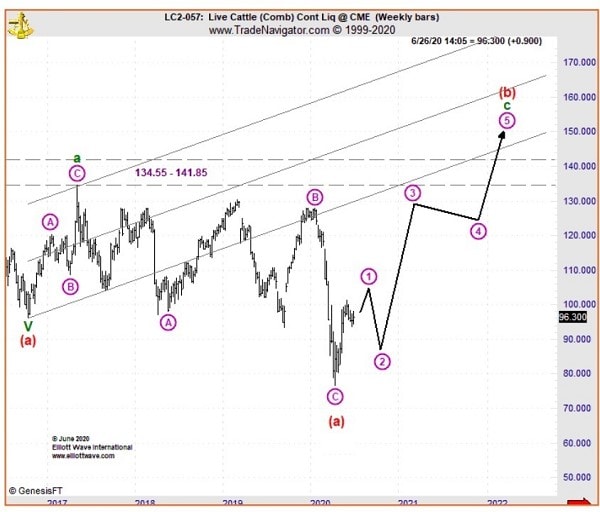

Here, we go back to our June 2020 Monthly Commodity Junctures, where we posted this weekly price chart of live cattle. There, the Elliott wave picture called for prices to embark on a powerful, five-wave rally in not just months but years ahead.

And, this is what followed. Cattle prices reclaimed the upside in a 3-year long bull run to lifetime highs.

Of course, trading commodities is a lot like the seasonal migrations of wild animals. Both involve tremendous risk for what ideally is a lush and verdant breeding ground on the other side. But the odds of reaching that ground significantly increase when you’re following the right navigational path.

Elliott wave analysis is an objective approach to interpreting price trends and enables one to define clear support/resistance levels to help minimize risk every step of a position.

Right now, in the July 28 Commodity Junctures (our new, long-term educational service) presents an updated price chart and analysis for where prices may be headed in the coming weeks, and months.

Commodity Prices Are on the MooooVe!

When it comes to knowing the future of commodity prices, there’s no such thing as a silver bullet. Even the most jarring Black Swan events like that of the pandemic can’t accurately determine where prices will go.

The only confident measure of a market’s trend is investor psychology, which unfolds as Elliott wave patterns directly on price charts. Right now, our Commodity Junctures presents high-confident outlooks for the world’s leading names in livestock, grains, softs, foods, and more.

See below to turn a new page in your investment future.