On Dec. 10, a federal judge blocked the merger of grocery giants Kroger and Albertsons, saying the deal would eliminate competition and lead to higher prices. But does the judge know what really drives food prices? Read this excerpt from our December Global Market Perspective:

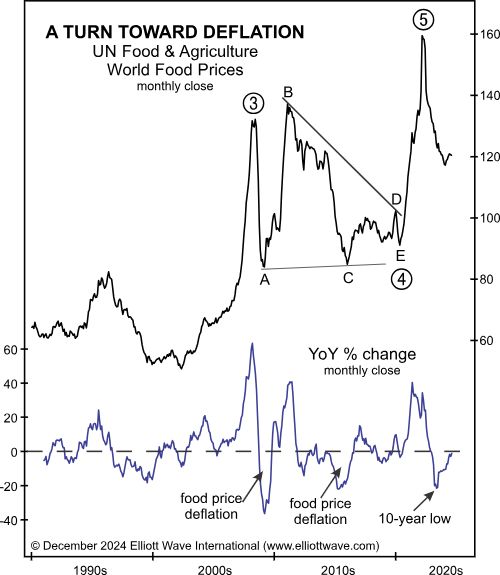

Since 1961, the United Nations Food and Agriculture Organization (FAO) has tracked monthly changes in international prices of a basket of food commodities, including cereals, vegetable oils, sugar, meat and dairy. The pattern of this price index since the late 2000s shows a well-formed contracting triangle, which we are imputing to be a fourth wave. If the wave labeling is correct, then the spike to 160 in March 2022 was the end of wave 5, which also ends a much longer-term uptrend. Earlier this year, the index’s year-over-year percent change hit a 10-year low and now rests near zero:

Is anyone else observing these signals of deflation? Last week, in discussing the likely effect of a U.S.-European tariff war, ECB president Christine Lagarde told reporters that it “would be difficult to assess, but if anything would cause prices to pick up pace” (WSJ, 11/28/24). Nonetheless, we could quite easily see the logic going the other way. If today’s disinflationary trends lead to a bout of outright price deflation, then retaliatory tariffs and trade restrictions will be blamed for reducing consumer demand, slowing economic activity and negatively impacting business investment. In hindsight, the resulting deflation will be viewed as quite logical.

How about you? Are you tired of being fed the same old stuff about how and what REALLY moves markets? Maybe your financial information diet needs a complete overhaul! Follow this link now.

Or, you can access a sample of our global market insights for free. Check them out here.