Alarm bells ring. Interest on the rapidly rising national debt of more than $36 trillion now exceeds the defense budget! And, according to the U.S. Government Accountability Office, 2024 marked the fifth year in a row that the U.S. saw a budget deficit north of $1 trillion. Investors are increasingly worried about the fiscal health of the U.S., as our February Global Rates & Money Flows explains:

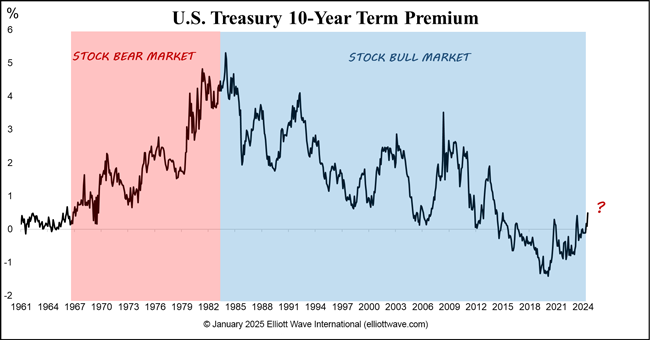

The U.S. Treasury 10-Year Term Premium is now at its highest level in a decade and appears to be on a rising trend. The inference from this is that the U.S Treasury market faces increasing challenges as people’s perceptions of it deteriorate. A failed government bond auction would be like a grenade being chucked into the global capital markets, but the rising term premium tells us that we should not be surprised if it happens:

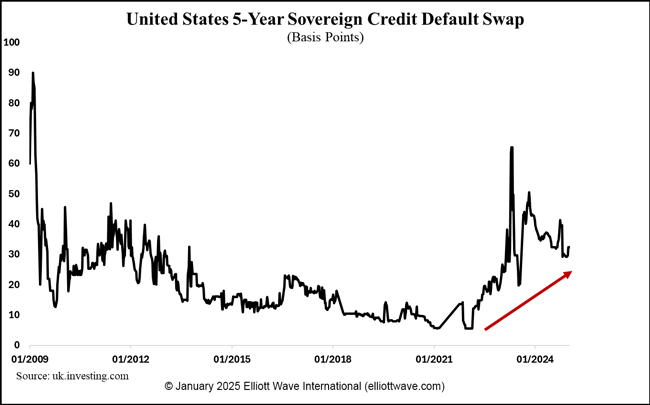

Default risk is already on the rise for the U.S. government as can be seen from the chart below of the 5-Year Sovereign Credit Default Swap (CDS). This is the cost of insuring against a default, and it has risen six-fold since 2022, advancing from just 5-basis points to over 30. Expect this to continue to rise as worries increase over the U.S. fiscal situation:

Murray Gunn, who is at the helm of EWI’s Global Rates & Money Flows, has worked as a fund manager in global bonds, currencies and stocks, including long posts at Standard Life Investments and the Abu Dhabi Investment Authority. Find out how to get more of his global financial insights by following this link.

If you would like to get more samples of our work before subscribing, sign up to get them sent straight to your inbox – FREE.