There are now S&P options that expire each day of the week. What that may mean.

Here’s a Wall Street Journal headline from a couple of months ago that some people may have scanned without much contemplation (Jan. 11):

VIX, Wall Street’s Fear Gauge, Extends Longest Lull Since 2021

While some investors may not consider a subdued VIX highly significant, Elliott Wave International does. As we’ve repeatedly stated: prolonged periods of low volatility in the stock market are inevitably followed by jumps in volatility — and often, those jumps can be quite high.

With the “lull” in the VIX so extended, the next surge higher in volatility may be exceptionally high and last for an exceptionally long period of time.

Yet, there’s at least one more strong reason to expect a super surge in the fear gauge.

This chart and commentary are from our March Elliott Wave Financial Forecast:

The CBOE Volatility Index (VIX) is purportedly a measure of expected future volatility in 30-day S&P 500 index options, but in fact it’s a real-time reading of complacency vs. fear. The index has been subdued, declining to 17.06 on February 2 in conjunction with [an Elliott wave] rally. This was the lowest VIX since January 5, 2022, the very day of the Dow’s all-time high. So, investors are as complacent now with respect to a stock market decline as they were when the blue chip indexes hit top tick in the great bull market.

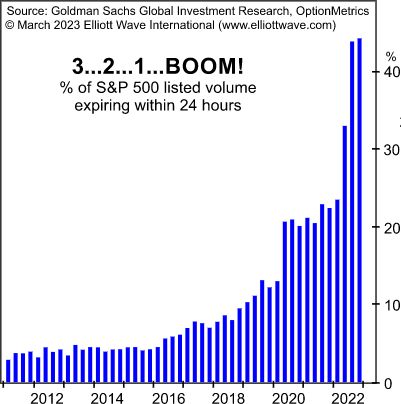

Digging deeper, we find a segment of investors who are using the market to make casino-style bets. According to Bloomberg, more than 40% of the S&P 500’s total options volume occurs in what is known as “zero-day-to-expiry” options, or 0DTE, as shown by this graph. These are options that expire within 24 hours, making them highly sensitive to changes in price because of the lack of time premium. In 2022, the CBOE and CME expanded existing options so that there are now S&P options that expire each day of the week, allowing investors to speculate using these ultra-short-term instruments. Options dealers have to hedge against the risks of outsized moves in 0DTE options, which increases the potential for an explosive rise in volatility.

If another major leg down occurs in the stock market, wrong-way bets in highly leveraged 0DTE options will spike volatility.

The question is: What are the chances that the price downtrend which began in January 2022 will intensify?

While Elliott wave analysis offers no guarantees (no market analytical does), the stock market’s current Elliott wave structure is highly revealing.

Learn what may be just ahead by following the link below.

Elliott Wave Junctures: The Right Place at the Right Time

Sometimes, sheer luck is why we find ourselves in “the right place at the right time.”

Yet in the world of investing, you can go broke before you get lucky — if you don’t have a proven method for participating in financial markets.

We invite you to take a close look at the Elliott wave method.

This quote from Frost & Prechter’s book, Elliott Wave Principle, provides insight as to why:

When… the apparent jumble gels into a clear picture, the probability that a turning point is at hand can suddenly and excitingly rise to nearly 100%. It is a thrilling experience to pinpoint a turn, and the Wave Principle is the only approach that can occasionally provide the opportunity to do so.

True, no analytical method of financial markets can offer a guarantee, yet the Elliott wave method is the best of which we know.

Follow the link below to learn how to put our team of Elliott wave experts on your side.