Over the past six months, major currency markets have seen some dramatic moves.

Mainstream financial media has largely pointed to two key drivers:

- The 2024 U.S. presidential election

- The Federal Reserve

These explanations may seem logical in hindsight. But markets rarely move in neat correlation with headlines. A more useful question might be: Who was tracking these moves before they happened?

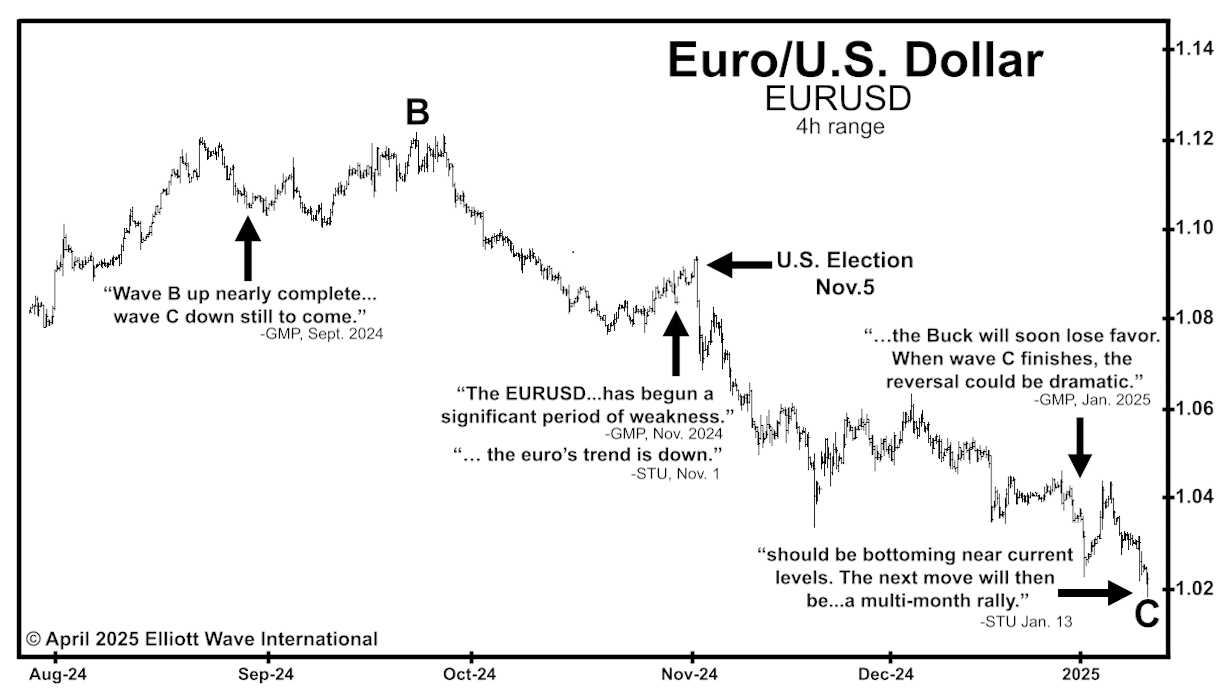

Take EURUSD — the world’s most actively traded currency pair. From October 2024 to mid-January 2025, the pair declined sharply, reaching a 14-month low.

Our September 2024 Global Market Perspective (GMP) noted that a B wave peak was likely in place, and it projected a downward C wave to follow. That analysis came well before the U.S. election on November 5.

Then on November 1, just days before the vote, GMP called for “significant weakness” in EURUSD. That same day, our Short Term Update (STU) identified that “the trend is down.” This wasn’t based on political speculation — it was based on market patterns we’ve studied for decades.

Fast-forward to January: on the 3rd, GMP anticipated a major reversal in EURUSD. Ten days later, on January 13, STU called for “a multi-month rally” — which began the very same day.

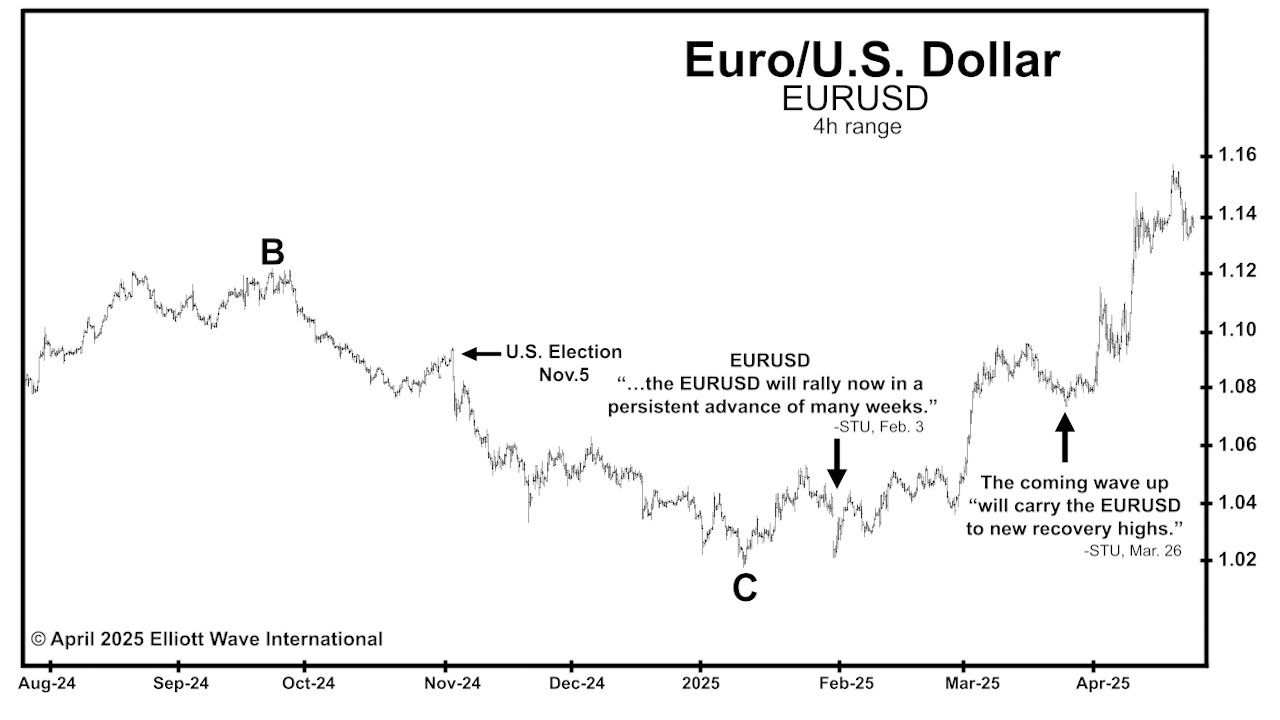

As prices climbed into February and March, STU kept subscribers informed of short-term pullbacks and the larger upward trend. And ahead of another sharp move on April 21, financial headlines once again turned to political themes.

Yet on April 16, STU had already flagged a notable sentiment shift and the potential for a downturn.

The takeaway? While news tends to explain moves after they happen, our analysis focuses on anticipating them — using Elliott wave patterns and market behavior.

See What’s Next for Key Currency Pairs

Join EWI Senior Currency Strategist Michael Madden on Thursday, May 22 at 1PM Eastern for a real-time look at the Elliott wave patterns in the U.S. dollar — and what they might mean for major currency pairs in the days ahead. There are two ways to attend the live session.