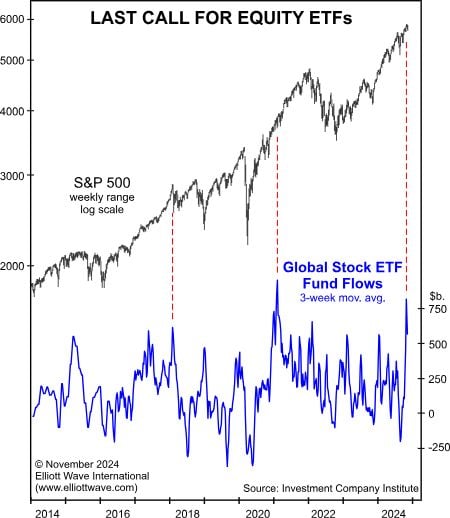

Investors’ go-for-broke mindset is evident as you look at the inflows into equity ETFs. Our November Elliott Wave Financial Forecast says we may be approaching another speculative peak:

Late in a major bull market, it is not unusual for the Dow Jones Industrials and the NASDAQ to move hundreds of points in opposite directions. As stocks wobble, however, investors have been diving in. Here’s the latest update on the most popular equity instrument from the Financial Times in early October: “ETF Flows Smash Record in Third Quarter.” At $500 billion, global inflows were 25% higher than the prior high in the first quarter of this year. “ETF records aren’t going to be broken this year, they’re going to be destroyed,” said Bloomberg’s ETF analyst. The chart below shows that global fund inflows reached a fever pitch on October 9, when the three-week average hit $8.1 billion. The only higher reading in history, $9.4 billion, came at the equity market’s speculative peak in January 2021, when memes, IPOs, SPACs and other speculative vehicles topped. The highest reading prior to that was $6.1 billion at the end of a third wave in January 2018. As noted above, this turned out to be a critical market juncture:

A lot of investors are wondering if the stock market rally is set to last. Our analysts are monitoring the Elliott waves of the main stock indexes and lay out our latest analysis in the new December Elliott Wave Financial Forecast, which we publish Dec. 6. Be sure to tap into our insights by following this link.

Want more market insights like this? Sign up to get our FREE newsletter sent straight to your inbox.