In the first quarter of 2021, the electric vehicle mania was intense. Around that time, dozens of electric vehicle and battery companies went public.

Even so, our March 2021 Elliott Wave Financial Forecast warned:

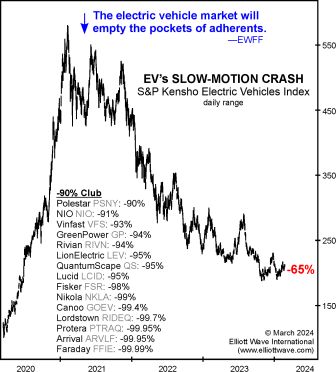

The electric vehicle market … will ultimately empty the pockets of adherents.

Indeed, a slow-motion crash in the EV market is well underway. Here’s a chart and commentary from our March 2024 Elliott Wave Financial Forecast:

A broad EV index is currently down 65% from a peak on February 9, 2021, while the blue-chip EV company, Tesla, is down 52% from a top on November 4, 2021. The inset on the chart shows there are 15 companies whose share price is down 90% to 99.9% from their respective peaks.

The fizzling of the electric vehicle mania is also reflected in this headline (Business Insider, Feb. 28):

Apple’s EV exit shows the challenges of the once red-hot market

Apple cancelled its plans to build an autonomous electric vehicle after spending more than 10 years and millions of dollars on research and development.

Apple may be exiting the EV market, but China is not. This is a Feb. 27 New York Times headline:

China’s Electric Vehicles Are Going to Hit Detroit Like a Wrecking Ball

Those who were excited about investing in electric vehicle companies in the first quarter of 2021 may have underestimated the extent of the competition in the market. Some Chinese automakers offer electric vehicles which sell for as little as $11,000.

Another factor that EV investors may not have recognized is that manias usually have a way of flaming out, or at least undergoing major pauses.

Will this soon apply to the mania surrounding the shares of companies heavily involved with Artificial Intelligence, or indeed the overall stock market?

Get our latest insights and forecasts for major U.S. financial markets by following the link below.

Electric Vehicles and the Slow-Motion Crash

When a financial mania is in full force, very few anticipate its end. Consider the frenzy surrounding the electric vehicle market three years ago. Here’s a review of what’s happened since.