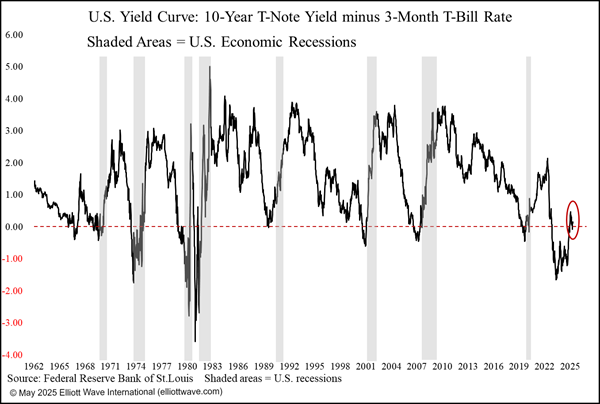

Financial and economic indicators are not crystal balls but it’s good to be aware of them. Here’s what our May Global Rates & Money Flows has to say about the yield curve and recession:

The latest U.S. Gross Domestic Product figures reveal an annualized contraction of 0.3% in the first quarter of 2025. Much of the shrinkage can be put down to companies trying to front run the trade tariffs being imposed by the new government as they loaded up on imports and, therefore, inventories. Another negative reading in the second quarter will mean that the U.S. economy is officially in recession.

The chart below shows the U.S. yield curve. Famously, the past eight recessions since 1969 have been presaged by the curve going from inversion (below zero) back to normal (above zero). The yield curve started to normalize in December last year:

Would you like to know our latest take on bond yields? Check out our Global Rates & Money Flows by clicking on the button below.

If you’re not ready for a full subscription, you can access only our May issue of Global Rates & Money Flows by following this link.