The Department of Education just said that student loan collections could resume as early as this month (May) after a pause due to COVID-19. Some five million student loan borrowers are in default and another four million are in late-stage delinquency. Last Chance to Conquer the Crash warned that the failure rate of student loans would rise. Here’s an excerpt from the book:

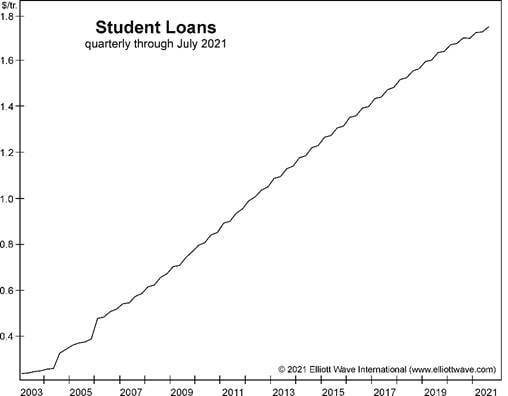

One of the things keeping total debt from falling further is the tremendous increase in student loans, as you can see in the chart below:

Total student debt has reached $1.75 trillion [in 2021]. Although this is private debt held by individuals, it is promoted and backed by the government. These are the same conditions that jacked up real estate debts and prices before the last bust.

If borrowing continues forever, then deflation won’t happen. Is student-loan borrowing going to continue its upward trajectory? Not a chance. Many students who owe money cannot or will not pay, and the failure rate is rising. Deflation will wipe out most of these debts.

Has debt deflation already begun? Let’s put it this way: Jobs in the debt collection business will likely soon skyrocket. Get our analysis of the economy and deflation by reviewing our flagship services now.

Are YOU prepared for a major debt implosion? If you’re unsure, read our special report “Preparing for Difficult Times” now – it’s FREE.