The CNBC headline below gives the Who, What, When and (alleged) Why:

Who: Oil

What: Tumbles 6%

When: On March 15

Why: As banking crisis routs markets

In case you’ve been living under a rock, the cited banking crisis occurred on March 10, after the failed resuscitation of Silicon Valley Bank, the “biggest US bank failure” since the 2008 financial meltdown. The domino falling effect proceeded to take down several other banking behemoths and their stocks.

And crude oil hit the skids. That’s the story Wall Street’s sticking to.

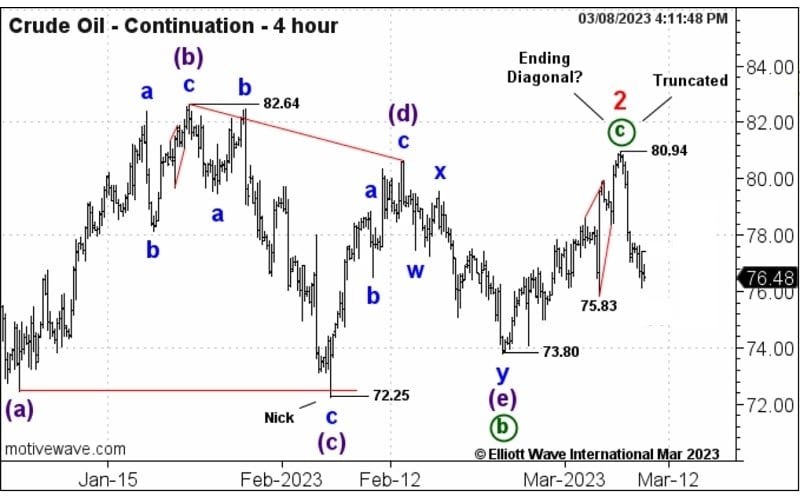

But on March 8, before the SVB shot was even loaded into the social media barrel, our Energy Pro Service warned that oil was set to slide.

Energy Pro Service Daily Update

3/08/2023 4:19:44 PM:

“Assuming that wave 2 is complete, Crude needs to extend the decline below the 73.80 swing low and more importantly, below 72.64 (April’s low comparable to 72.25 on the continuation chart) to strengthen the case.”

On March 9, Energy Pro Service confirmed the bearish wheels were greased:

Daily Update: 3/09/2023 4:38:14 PM:

“If the wave (ii) peak is in place, Crude should ratchet on down in an impulsive manner. Any backing and filling should prove corrective and set the stage for further decline.”

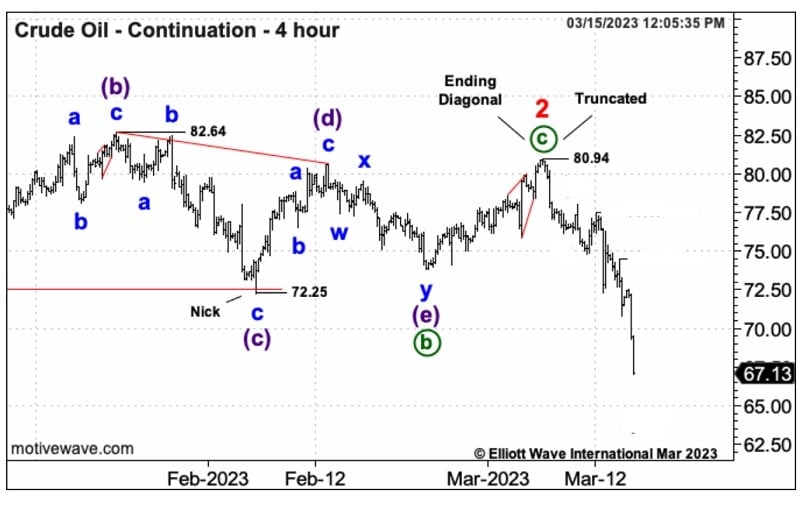

The result: Crude impulsively broke through to the downside to its lowest level in 3 months on March 15.

The banking implosion has only just begun to reverberate through the financial landscape.

But knowing where crude oil prices are headed doesn’t depend on how, when, or where that drama unfolds.

It depends on the Elliott wave pattern unfolding directly on the market’s price chart.

See for yourself what a difference Elliott waves can make in your investing or trading.

Energy Opportunities on Every Time Frame

Before the Silicon Valley Bank bombshell exploded, our Energy Pro Service was ready for a fall in oil. For active traders watching the intraday, daily and weekly movements, this service presents detailed analysis for every time frame, focusing on meaningful developments underway in crude oil, natural gas, heating oil and more.

Go from following market trends, to falling in line with their objective paths of least resistance!