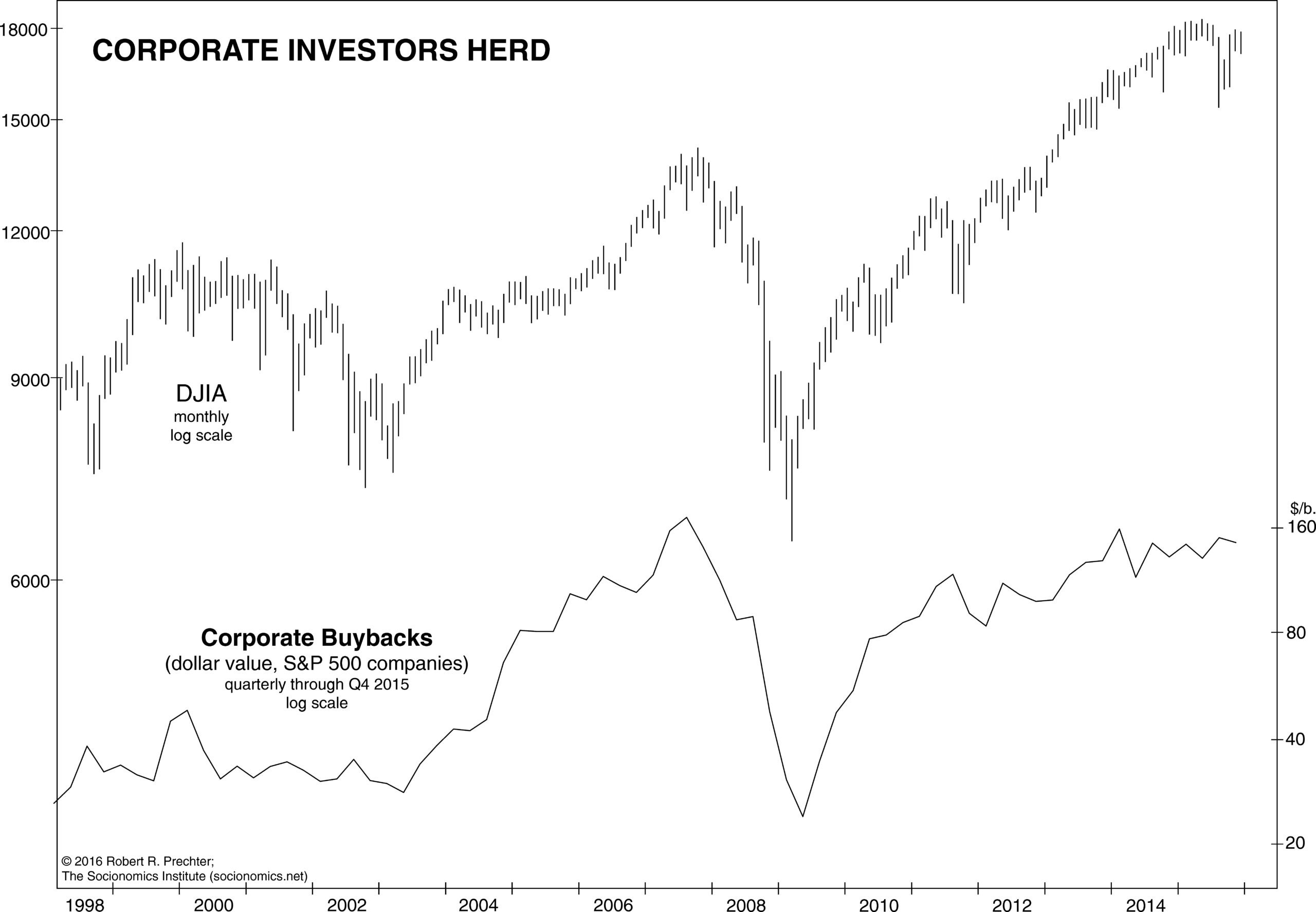

U.S. corporate executives plan to buy back their own shares in a big way. The value of announced buybacks reached $233.9 billion in April, according to Bloomberg. That’s the second highest amount going back to 1984. Talk about financial optimism! As Robert Prechter noted in his Socionomic Theory of Finance, corporate executives are just as much a part of the crowd as everyone else. Here’s an excerpt from that landmark book:

Most people would be surprised to find out that even corporate insiders herd. It may seem that “inside information” should give company managers an advantage in deciding when to engage in buybacks of their own company’s stock. On the contrary, their misperceptions are the same as everyone else’s. When the stock market goes up for a long time, corporate health factors strengthen, and when it goes down, they weaken. Insiders misinterpret these indications of their company’s present health as being the same as its prospects. Whenever their stock gets expensive, they think it’s cheap, because they feel optimistic about the company’s future. At such times they also tend to have more cash on hand to spend on investment. When managers get really optimistic, they may direct the company to borrow money to fund a stock-buyback program. This strategy has been standard practice in recent years. As the chart below shows, corporations buy back lots of stock near market tops and very little near market bottoms. If they did the opposite, they would thrive. They aren’t rationally analyzing insider information; they’re pre-rationally herding like all the other groups:

WHAT are corporate executives doing now? Get our latest insights by clicking on the button below.

Get more insights into how financial markets work by reading Chapters 1 & 2 of The Socionomic Theory of Finance – FREE!