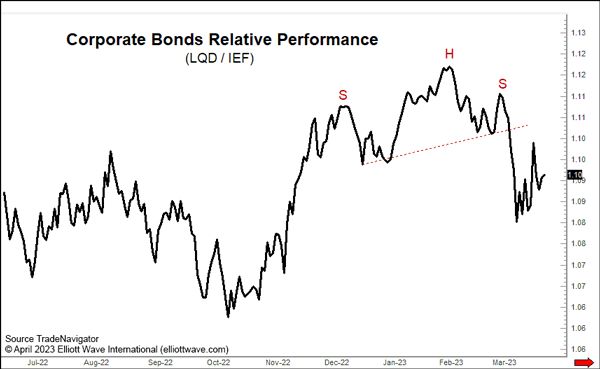

“The neckline has been broken over the last few days”

A “calamity” is likely ahead for corporate bonds, says our head of global research, Murray Gunn.

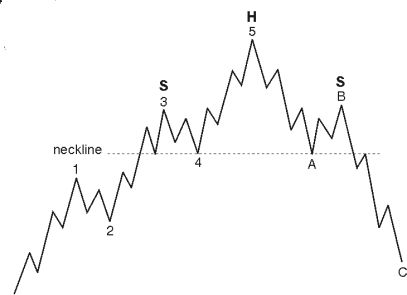

Some of Murray’s analysis involves the head and shoulders, a classic technical chart pattern. In case you’re unfamiliar with it, here’s an illustration along with an explanation from one of our past publications:

A head-and-shoulders is a reversal pattern that consists of three price extremes. Market technicians refer to [them] as the left shoulder, head, and right shoulder… it takes a break of the neckline to confirm a reversal… [and it’s] not just a bearish reversal formation. Inverted head-and-shoulders mark bottoms.

With that in mind, here’s a chart and commentary which Murray provided for our April Global Market Perspective:

The chart… shows the relative performance of corporate bonds, as proxied by the iShares iBoxx $ Investment Grade Corporate Bond ETF (ticker LQD) versus the iShares 7-10 Year Treasury Bond ETF (ticker IEF). A distinct Head and Shoulders pattern exists where the neckline has been broken over the last few days. The corporate bond market has held in reasonably well over the last year, but we fully expect this sector to be the next shoe to drop.

Don’t count on the ratings services to provide timely warnings. In the past, downgraded ratings have sometimes come only after most if not all of the damage was done.

Remember Enron? The company still had an “investment grade” rating just four days before it collapsed. Ratings services also missed the 1995 debacle at Barings Bank. Olympia and York of Canada is another historical example: the largest real estate developer in the world at the time had a AA rating on its debt in 1991. Less than a year later, it went bankrupt.

Getting back to the present, Murray Gunn also notes:

When… corporate loans are re-set this year, there are going to be a few deep breaths being taken, and more than a fair share of tightened sphincters!

Get all of Murray’s commentary, as well as our outlook on an array of major financial markets, in our Global Market Perspective.

Get started by clicking on the link below.

A SINGLE Decision Can Decide Your Financial Fate

An investor who buys at the right time can reap a life-changing reward. And in the same way, one who sells near a key market juncture can protect a portfolio that took a lifetime to build.

Here at EWI, we don’t claim to have all the answers.

But — our analysts do have confidence in their market analysis (the Elliott wave method).

We’re ready to share our Elliott wave forecasts for 50-plus global financial markets with you.

Learn about our Global Market Perspective as you follow the link below.