This index has already retreated 20% since May 2022

The major bust in property prices 15 to 20 years ago started with the residential real estate market.

This time, the commercial real estate market may have taken the lead. Here are some recent headlines:

- [“Shark Tank Star”] Says a Coming Real Estate Collapse Will Lead to ‘Chaos’ – Yahoo Finance, Jan. 30

- Commercial Property Losses Hammer Banks on Three Continents (Wall Street Journal, Feb. 1)

- Bracing for the commercial real estate ‘reckoning’ – Reuters, Feb. 2

As rough as it’s already been for the commercial real estate market, it appears that “reckoning” is only in its early stages.

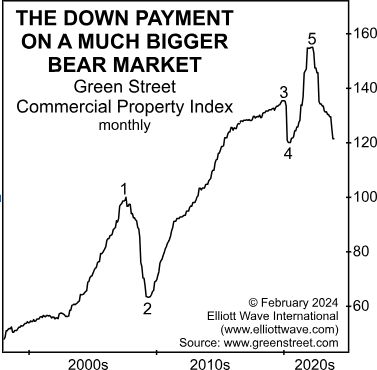

Keep in mind, as you review this chart and commentary from our February Elliott Wave Financial Forecast, that progress in a market takes the form of five waves. Once those five waves are complete, a correction is due:

This chart of the Green Street Commercial Property Index shows the latest decline, a 20% retreat from May 2022. In terms of time, the 20-month plunge is already close to the 22-month decline from September 2007 to June 2009. … [T]he crumbling demand for commercial space, not to mention the five-wave form of its rise from 1998, suggests that further declines are “baked in.”

The U.S. commercial real estate market is valued at $20 trillion, according to Bloomberg, so the developing crisis is not a minor ordeal.

Part of the reason the full brunt of the crisis has been delayed is that many loans have been granted extensions.

When those mature loans are refinanced, some borrowers could see their interest rates skyrocket. This could set off a wave of defaults.

Business Insider recently quoted an economist who specializes in the property sector (Jan. 23):

“[B]uilding owners are looking to ‘extend and pretend’ but that strategy can’t last forever as there’s still a $2.2 trillion mountain of commercial real estate debt that will mature by 2027.”

Some building owners have already experienced a lot of financial pain. For example, Aon Center – the third-tallest tower in Los Angeles – sold for $147.8 million. That’s 45% less than its 2014 purchase price.

This is just one example of what’s going on in commercial real estate.

Also know that the property and stock markets tend to be correlated.

Get our latest analysis of U.S. stocks, the U.S. economy and major financial sectors by following the link below.

Read the NEW Elliott Wave Financial Forecast

The just-published March Elliott Wave Financial Forecast is online and ready for your review.

You’ll find in-depth coverage of major U.S. financial markets like stocks, bonds, gold, silver, the U.S. Dollar and more.

Also, get our analysis of stock market darling Nvidia Corporation – specifically, from an Elliott wave perspective.

Learn about the Elliott Wave Financial Forecast, U.S. Short Term Update and Elliott Wave Theorist (all three comprise our Financial Forecast Service) by following the link below.