Here’s evidence that financial authorities tend to be reactive – not proactive

In his groundbreaking book, The Socionomic Theory of Finance, Robert Prechter delves into 13 widely accepted claims about the market which are in truth – myths.

These myths mislead investors. As a result, countless portfolios have been damaged. Learn about these myths for free by following the link below.

In the meantime, I’d like to point out just one of those widely believed claims – the one that says governmental and monetary authorities have the power to keep the stock market elevated and even thwart recessions and depressions.

Let’s set the stage with this quote from The Socionomic Theory of Finance:

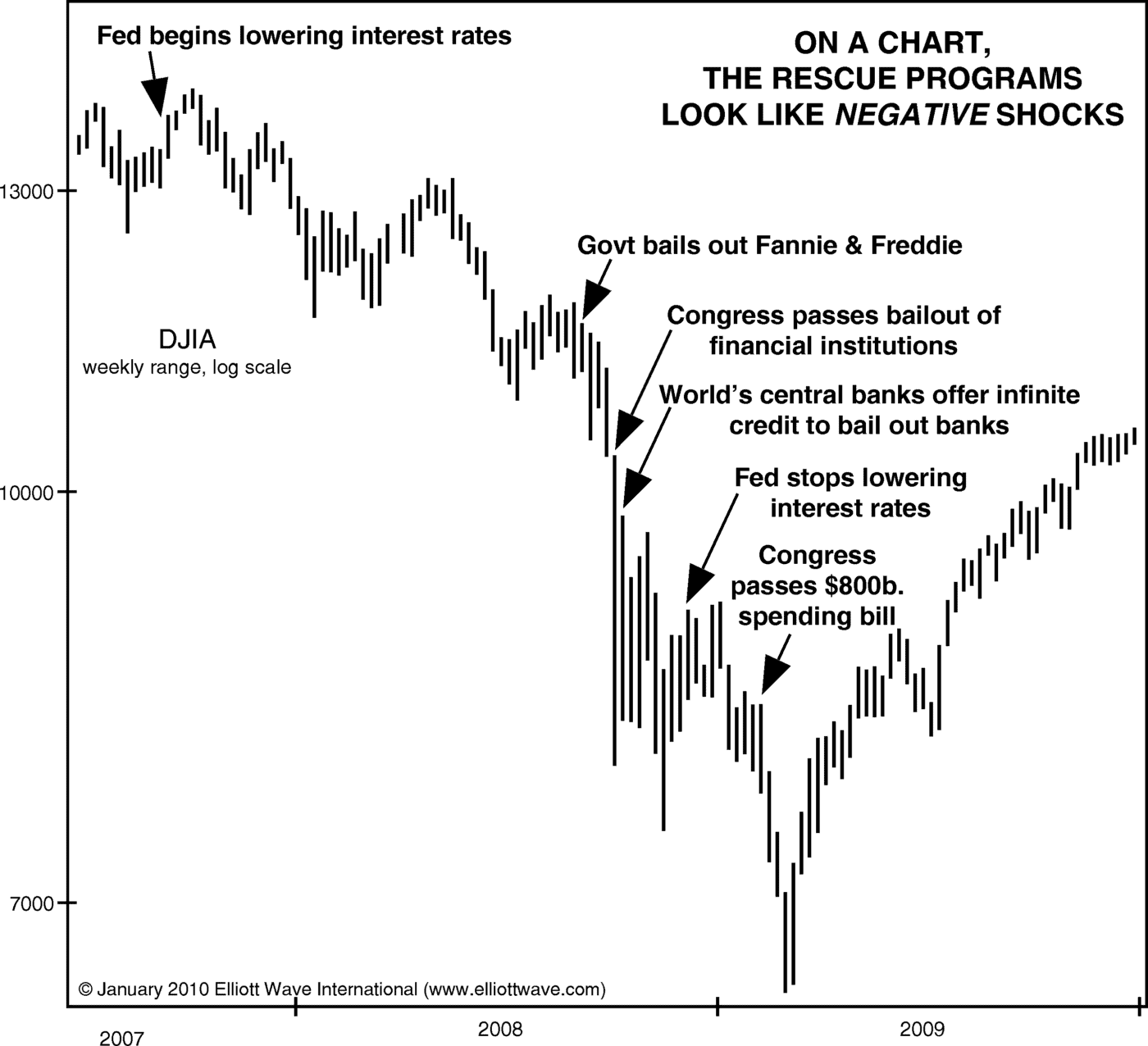

In 2007-2008, the U.S. government announced that it would fully back the debt of the mortgage companies it had created, Fannie Mae and Freddie Mac. It pledged to use unlimited amounts of money to fund banks that it deemed “too big to fail.” It pledged that the FDIC would fund shortfalls at all other banks. At the same time, the world’s top central bankers offered banks unlimited credit at near-zero interest rates, in other words, free money.

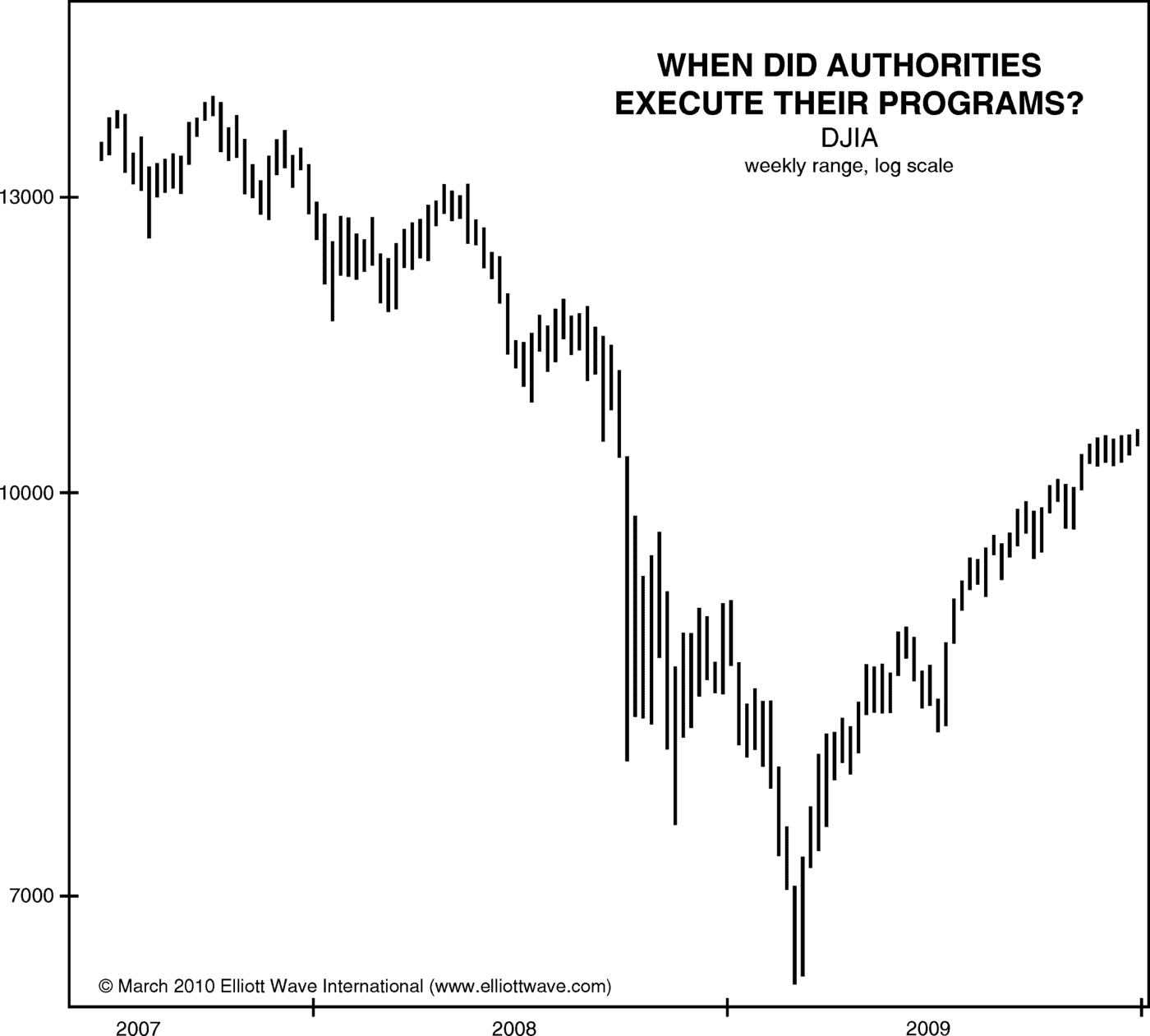

Now, look at this chart of the Dow Industrials from the book, which asks:

Can you tell where on this graph of stock prices authorities [made these historic pledges and] took these actions? According to the action-reaction model, the only logical place for them to have taken place would be at the bottom of the market. The day the authorities began flooding the market with liquidity is the day it should have turned up.

This next chart reveals that none of the many official actions during this period caused stock prices to turn up. On the contrary, the market kept falling, for seventeen months. The authorities did not act to prevent anything; they reacted all the way down. Ultimately, the presumably in-control Fed presided over the second-biggest plunge in financial prices and the second-biggest economic contraction of its century-long tenure.

Those who argue that the action-reaction model is valid may say that the Dow did eventually recover. This is obviously true, of course, but to attribute that price rise to the rescue programs is a big stretch. It appears the market found a bottom on its own.

Learn how we debunk other market myths as you read Chapters 1 and 2 of The Socionomic Theory of Finance for free. Get started by following the link below.

13 Market Myths That Mislead Investors

Learn What They Are in The Socionomic Theory of Finance

- Positive corporate earnings “cause” the stock market to rally.

- Higher bond yields “cause” stocks to drop.

- Inflation “causes” gold and silver prices to rise.

Many investors hear these claims so often that …

… They assume them to be irrefutably true. So, instead of challenging the claims and assumptions, they instead invest piles of their hard-earned money.

But know that Robert Prechter’s extensive research reveals that many widely held beliefs about what drives the stock market do not stand up under scrutiny.

In his groundbreaking text, The Socionomic Theory of Finance, Prechter digs into financial history to expose the most popular cause-and-effect market myths touted by economists, news outlets and brokers.

Read the first two chapters now for free and discover 13 dangerous investor myths.