Bitcoin’s meandering ups and downs have been frustrating traders lately.

But Elliott wavers know that overlapping price action usually means a corrective pattern is underway.

So, when our Flash services looked at BTC on February 6, we did see a pattern – and an opportunity:

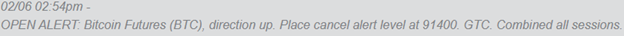

At 2:54 PM Eastern on February 6, our Futures Flash service told subscribers:

All the recent “directionless” ups and downs in Bitcoin start to make sense when you look at it as EWAVES does: Bitcoin appears to be building an ABCDE triangle wave pattern (for a larger wave 4 correction), with waves A, B and C of that triangle already in place and wave D up in progress. Within that D, we have wave A rally in place, which makes today’s ongoing decline a wave B — which, when complete, should give way to a rally in wave C of that larger wave D. (Whew! Yes, corrections are often messy affairs. But “messy” does not mean “unpredictable.” Probabilistically, of course.)

Futures Flash sent out an “up” alert at 2:54 PM Eastern, with BTC trading at 96,445:

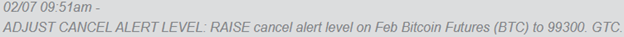

Friday morning, BTC jumped above 100,000, and Futures Flash alerted subscribers to raise the “cancel alert level” to 99300:

Minutes later, Bitcoin dipped from just above 100,000 and triggered the 99300 level, closing the alert.

The “triangle” Elliott wave pattern remains intact, though – maybe just on pause. Our Flash services are keeping watch for the next setup. Here’s what you get when you subscribe.