Argentina: “This is going to be fascinating.”

The complimentary excerpt you’re about to read was taken from Global Rates & Money Flows (November 22, 2023).

Global Rates & Money Flows is unlike anything else in your toolbox. Editor and 30+ year market veteran, Murray Gunn, brings you a well-thought-out, often contrarian perspective and actionable insights. You get a refreshingly unique commentary every market day and a broader money perspective each month.

In this excerpt, Global Rates & Money Flows Editor Murray Gunn examines the socionomic timing of Argentina’s newly elected leader.

Enjoy!

Time to Tango

This is going to be fascinating.

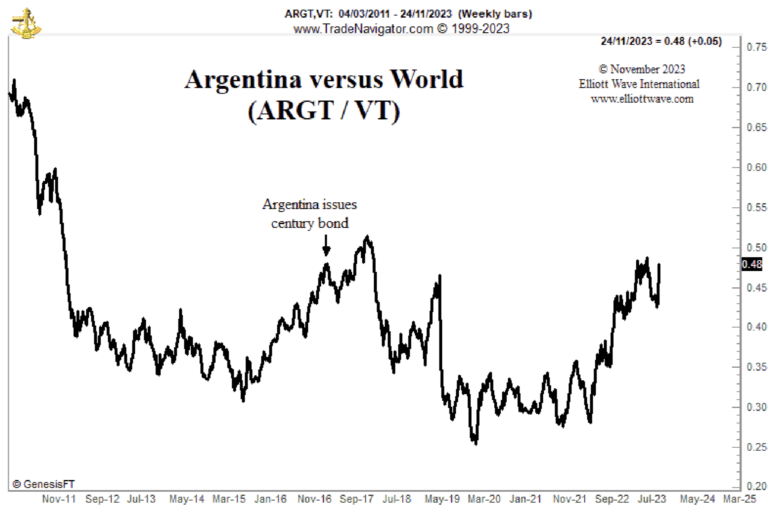

Where do you start with Argentina? Just over a hundred years ago, the south American country was one of the wealthiest and most successful in the world. Since then, decades of decline have beset the nation. The country has defaulted on its sovereign debt seven times since the 1950s, the most recent being after it issued a century bond in 2017 (at the time EWI noted that as being in tune with the madness towards the end of the free money era). Now, in 2023, the currency is in freefall, consumer prices are rising at over 140% per annum and over 40% of the population are living in poverty. Cue a big change in last weekend’s presidential election.

The election of Javier Milei as Argentina’s president makes socionomic sense. After decades of negative social mood, the country has elected someone who has vowed to literally demolish the central bank, U.S. dollarize the economy and close vast swathes of government. The ultra-libertarian economist faces massive challenges in putting those policies into action, but the eyes of the world are now on this experiment.

The Argentinian stock market, the Merval index, has advanced by over 220% this year. But socionomists must be careful when looking at stock markets as sociometers because context is key. Just as with Zimbabwe and Turkey, a surging stock market in nominal terms looks a lot different when adjusted for consumer price inflation and the impact of a plunging currency.

The chart below shows the Global X MSCI Argentina ETF (ticker ARGT) relative to the Vanguard Total World Stock Index ETF (ticker VT). With both ETFs priced in U.S. dollars, this comparison neutralizes currency effect. ARGT has underperformed the world since 2011 but, curiously, it has started to stabilize in relative strength since 2020. Is this a sign that Argentina is set for better days ahead? We’ll be following developments closely so stay tuned to find out.

Murray Gunn, MSTA, CFTe, CEWA, is Head of Global Research at Elliott Wave International. He worked as a fund manager in global bonds, currencies and stocks, including long posts at Standard Life Investments and the Abu Dhabi Investment Authority. Prior to joining EWI, he was Head of Technical Analysis at HSBC Bank. Murray is the author of the 2009 book Trading Regime Analysis and a contributor to Socionomic Studies of Society and Culture (Socionomics Institute Press, 2017). Murray is at the helm of EWI’s Global Rates & Money Flows and The European Short Term Update, while also providing commentary for Global Market Perspective.

Special Opportunities, Unique Insights

Global Rates & Money Flows is a necessity for income investors and a benefit to stock and currency investors.

Editor Murray Gunn surveys the global fixed income markets, analyzing charts and trends of sovereign, corporate, municipal and emerging market debt. Murray also examines changes taking place in money and currency markets, including digital currencies. From specific issues to a broad look at the macro economy and central bank machinations, Global Rates & Money Flows has it covered — giving you a stream of unique and actionable insights that keep you on top of current trends and conditions.

If you watch global trends, our new Global Market Perspective updates you with forecasts for 50+ of the world’s most-watched markets.