Complacency toward financial markets usually doesn’t end well. Our November Global Market Perspective reveals why smugness is about to be replaced by frayed nerves in Europe:

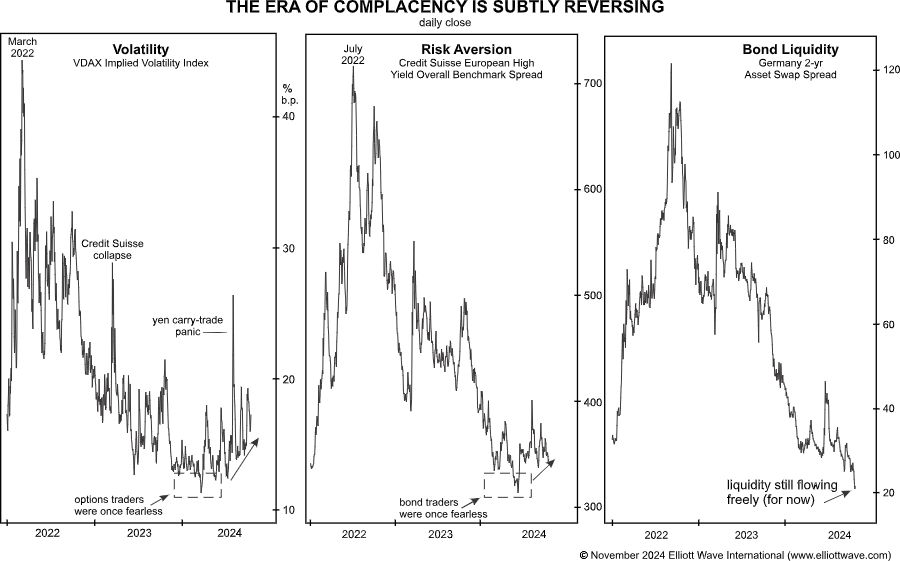

The duration of investor optimism forms a key pillar of our forecast for an epic stock market wipeout. The VDAX Implied Volatility Index (left graph below), which measures investors’ panic and complacency, fell to a 4-year extreme this past March. The metric typically ebbs and flows inversely with stock prices, making lower lows as stocks make higher highs and vice versa. For the past two quarters, however, the VDAX has quietly trended higher, even jumping to a 12-month extreme as stock investors panicked over the yen-carry trade in August. The DAX 40, meanwhile, reached a new all-time high on October 17. That means that stock prices are pushing higher alongside increasing fear, a dynamic that runs contrary to historic norms. It’s a subtle sign that investor psychology is reversing from optimism to pessimism alongside an equity trend that is switching from up to down at a high Elliott wave degree.

Gauges of bond market complacency show similar dynamics. The Credit Suisse European High Yield Overall Benchmark Spread (middle graph) approximates complacency and risk aversion using the junk bond market. The spread tends to narrow when bond traders grow complacent and buy junk bonds over investment-grade corporates. Here, too, the spread made a multi-year low earlier this year and has trended upward for months. The right graph illustrates liquidity in bonds, which flows freely (narrowing spread) when investors get complacent and dries up (widening spread) when they turn fearful. … With two metrics now moving in the anticipated direction, a reversal in the third, bond liquidity, should produce bearish effects across a wide variety of financial assets:

Another warning sign is showing up in forex. Get the details by checking out our Global Market Perspective now.

Get ready for major financial trend changes by reading Elliott Wave International’s special report “Preparing for Difficult Times.” It’s FREE!