Recent headlines about the U.S. economy are rosy:

- US economic growth for last quarter is revised up slightly to a healthy 3.4% annual rate (AP News, March 28)

- US economy continues to shine with help from consumers, labor market (Reuters, March 28)

It’s all well and good to announce positive economic news. Yet, consumers of such news may not be getting the full story.

In other words, there’s plenty of less-than-positive economic developments and I’ll point out just three which portend a possible economic contraction.

The first one has been well-advertised: the developing commercial real estate crisis. In a nutshell, office building owners face higher interest rates as their loans mature. This could set off a wave of defaults. Indeed, there’s already been a dramatic rise in the number of U.S. commercial property foreclosures in the past four years.

Another sign of a developing economic slowdown has to do with consumers. If you live in the U.S., quite a few of your neighbors – or at least residents of your community – are tapped out.

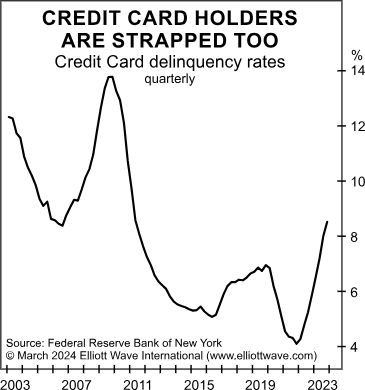

Here’s a chart from our March Elliott Wave Financial Forecast:

As you can see, credit card delinquencies have been rising since 2022. Indeed, credit card arrears are higher than they’ve been since the wake of the Great Recession in 2007-2009.

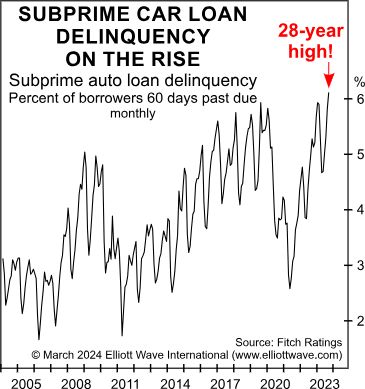

And speaking of the Great Recession, sub-prime car loan delinquencies are even higher than they were then.

Our March Elliott Wave Financial Forecast elaborates with this chart and commentary:

Car loan delinquencies are higher than at any time in the data’s history, which goes back to 1996. … Credit standards are tightening, thereby freezing out borrowers. …. Access to auto credit is the lowest in nearly four years.

Also keep in mind that the economy follows the stock market.

If the stock market goes into a correction – or worse – expect the economy to weaken. History shows that there’s usually a few months lag time between the action of the stock market and economy.

Get our detailed outlook for U.S. stocks – as well as the economy – by following the link below.

3 Signs of Developing U.S. Economic Slowdown

“Credit standards are tightening, thereby freezing out borrowers”

The U.S. economy grew 3.4% in Q1, yet there are at least 3 signs that trouble is brewing. Indeed, the number of delinquencies are higher now in this sector than they were in the wake of the Great Recession.