“No other presidential term in U.S. history contains anything close to such a move”

In a few moments, you’ll learn how to get Robert Prechter’s eye-opening book, Socionomic Causality in Politics, via a special offer.

But, first, we all know that the next U.S. presidential election is still more than a year away. Yet, as you’ve probably noticed, the political season is already in full swing. No doubt, it will get even more intense.

Even though several hotly contested issues are being debated, at least one factor that many investors care about can be expressed with this question: “Is a Democrat or Republican better for stocks?”

Here’s a quote from Socionomic Causality in Politics:

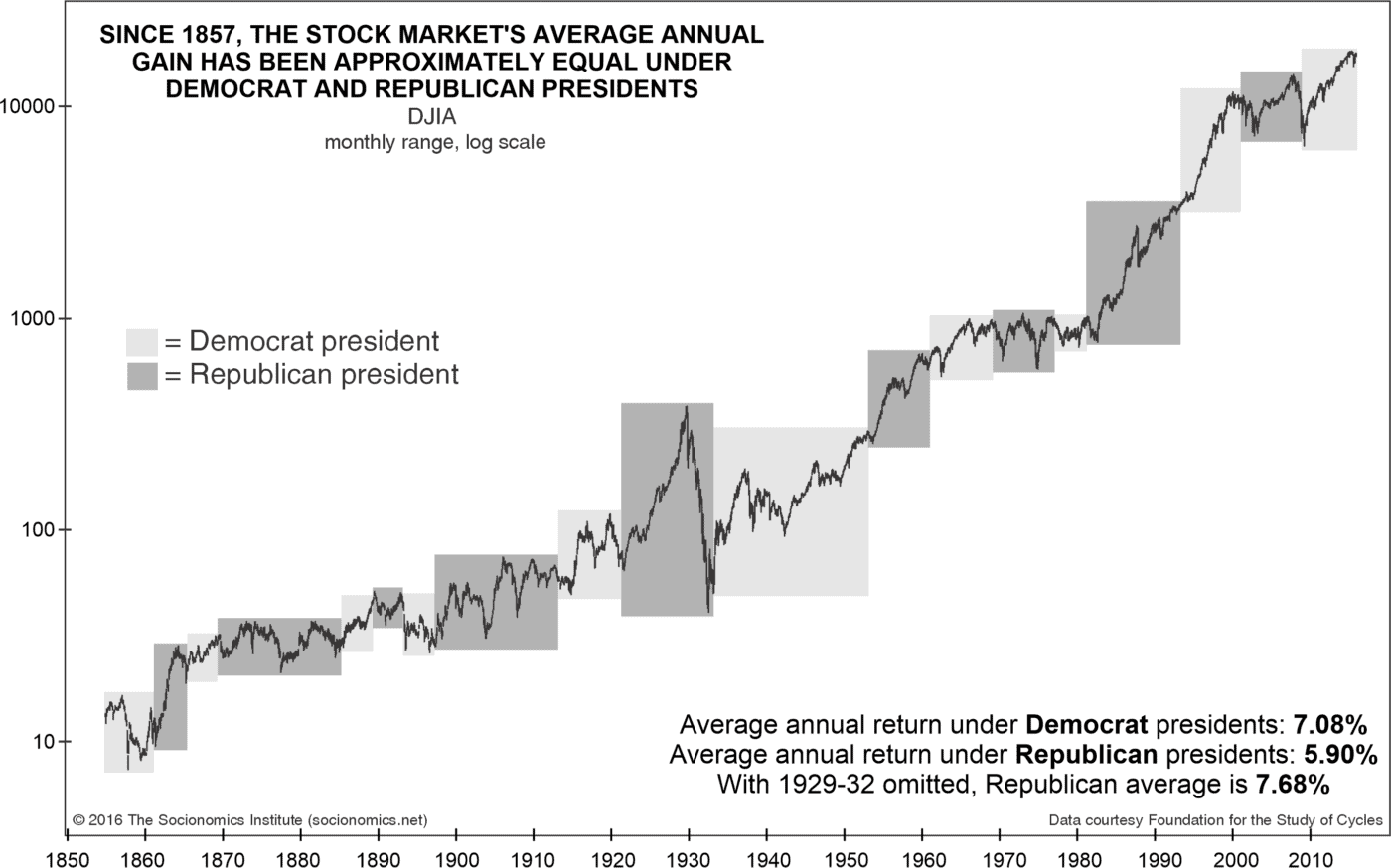

…from 1857 to 2015, there was a 7.08% average annual rate of return in the stock market under presidents who were Democrats, while under Republicans the rate was 5.90%.

But let’s dig deeper with this chart and additional commentary from the book:

From its high in 1929 to its low in 1932, the Dow fell a whopping 89%. The entire drop occurred within a single presidential term. No other presidential term in U.S. history contains anything close to such a move. When we omit the term encompassing 1929-32 from the analysis, the average annual rate of return under Republicans jumps to 7.68%, slightly higher than the 7.08% performance under Democrats.

Thus, all of the advantage in the market’s average performance under the Democrats over a period of 159 years is due to a change lasting less than three years, all in a single term when a Republican happened to be president…

In sum, the market has had nearly the same average annual performance under both parties.

Get insights into how social mood, as reflected by the performance of stocks, can largely influence when dictators come to power, the degree of nuclear fears, the outcome of elections and even war and peace.

You’ll find a special offer for Socionomic Causality in Politics below.

Limited Time: Get Socionomic Causality in Politics shipped straight to your door (and save 57%)

When we released Socionomic Causality in Politics in 2017, it became an Amazon #1 bestseller in behavioral psychology. More vital to understand now than ever, this book is available for a limited time at 57% off when you buy directly from EWI. Order your copy today!

Within the U.S.

$35 $15

Includes FREE shipping in the U.S.

International (Outside the U.S.)

$35 $15

+ $20 flat-rate shipping