Learn to Harness the Power of

Elliott Wave Analysis from Robert Prechter

“The finest Elliott wave material ever produced“

In 1987, Robert Prechter brought together the world’s brightest Elliott wave practitioners and instructors. Together they created EWI’s 10-volume Elliott Wave Educational Video Series.

By the time the team was finished, they had invested 1,500+ painstaking production hours into the project. That effort ensured the top-notch quality and clarity of each video lesson.

This 10-lesson classic video series has since been hailed as “the finest Elliott wave material ever produced.”

It remains the most comprehensive Elliott wave education available today.

“This course is excellent for everyone, whether you’re experienced or not. It will instantly improve the beginner’s knowledge, and they can actually start applying this information to their trading. Also, this is a must-have for the experienced Elliottician, as a study/review reference guide. Taking this course was a very good decision. I am very satisfied!” — Richard L., Garland, TX.

Meet your expert instructors…

and put their almost 100 years of market experience on your side

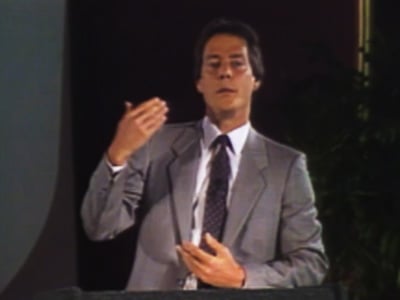

Robert Prechter

Veteran market forecaster and best-selling author

Bob began his professional career in 1975 as a Technical Market Specialist with the Merrill Lynch Market Analysis Department in New York. He has been publishing The Elliott Wave Theorist since 1979 and is the president of Elliott Wave International. He is also Executive Director of the Socionomics Institute, which studies social mood and its impact on social action, including the stock market and the economy.

Dave Allman

Elliott Wave instructor, world-traveled lecturer

(Years of direct market experience: 48)

Dave Allman graduated from the University of Maryland at the age of 19 with a degree in mathematics. He has worked closely with Bob Prechter since 1983. Dave has lectured around the globe on the application of the Wave Principle and investor psychology and has taught advanced classes on Elliott wave analysis to hundreds of investors. Today, Dave is active behind the scenes on a variety of projects at Elliott Wave International and the Socionomics Institute.

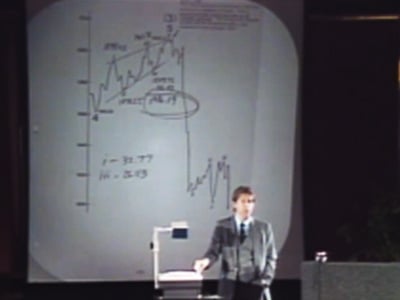

Enjoy a step-by-step learning experience as you learn how to apply Elliott wave analysis to your price charts — any market, any timeframe

This classic learning course takes you on a journey of discovery via the 10 lessons.

Each step builds your understanding of the Elliott wave model. You start to see Elliott waves in your markets. A seemingly random price chart becomes a detailed roadmap.

What’s more, this course also teaches you how to properly handle each opportunity like a pro, using concise rules, guidelines and calculated price levels.

Gain a crystal-clear knowledge of the true force that drives the markets

Your step-by-step guide to understanding how markets’ psychological forces construct basic Elliott wave patterns – and how to use them to your advantage.

Learn to spot Elliott waves in any market with confidence

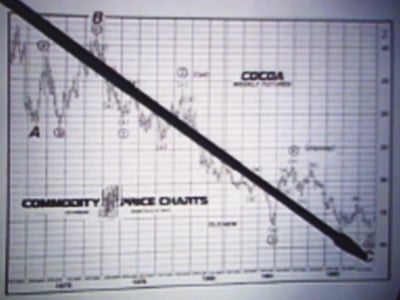

See how “being able to count to 5” is all you really need to start applying Elliott waves in the markets you watch. You’ll see how it applies in any market, from stocks to forex to gold to cocoa and more.

Discover the secret that 9 out of 10 traders don’t understand

Here’s the secret: In any liquid market you follow and at all degrees of trend, Elliott wave patterns are the same. Learn how to look at a single chart – and understand instantly where prices should go in the short, medium and long term, in real time.

Know when to expect EXPLOSIVE price action!

Market corrections are rarely exciting. It’s what comes after a correction that you want to be a part of. Learn how to identify the two major families of corrections and when to expect – and jump on! – the explosive price action that often follows.

Learn which Elliott wave “personality” fits your investment style best

The rules and guidelines of the Wave Principle are clearly laid out, along with the behavioral characteristics of each type of wave: 1, 2, 3, 4, 5, A, B and C. Learn them and become an expert.

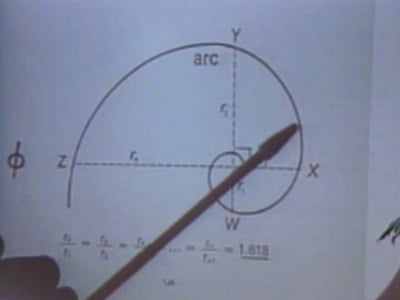

Apply the Fibonacci sequence to your Elliott wave analysis

Fibonacci ratios aren’t magic, but when you watch them in action, it often feels like it. Wouldn’t it be great if you could spot the exact price levels on your charts where the trends are most likely to stop and reverse? Imagine how much this would improve your entry and exit strategies!

How one nifty tool helps you see market’s future reversal points

You get a much better feel for the market when you project your targets directly on a chart. This old-school process helps you do just that.

Use Elliott waves to manage market risk in the REAL world

When is the best moment to open a trade? When is the best time to get out? You know how frustrating it is to leave money on the table, or to jump in too early. Learn to recognize Elliott wave signals when the risk is low – and see how to place a stop-loss at the most logical price point.

Trade options? Thinking about it? Watch this first!

In 1984, Bob Prechter used his Elliott wave skills to win the U.S. Trading Championship with a then-record 444% return in a monitored options trading account. See how to use one tactic to master most of the options-trading variables at once. Plus, you get Prechter’s three “MUSTS” for success.

Any questions? Learn even more from these insightful Q&As

Watch the most interesting questions and get informative answers on a variety of topics. Some are from fans, others are from skeptics… each one will teach you something you may have thought about before — but just didn’t know who to turn to for answers.

Your fellow investors who’ve taken the course say:

“I have read several books on the Elliott Wave Principle and watched many short videos on the subject and its application, but felt I was lacking comprehensive training that would bring everything together. This course has gone a very long way to addressing that and the videos will be a resource that I’m sure I shall return to until I’m finally happy that I’ve absorbed all of the nuances.” — Ian H., Kent, England

“Easy to understand. Clear directions. Exciting explanations.”

That’s how another student described his learning experience recently after taking this course.

By now, you’re probably wondering how you can jump in on this opportunity…

Clearance Pricing

(while supplies last)

10-DVD Set

16 hours$999

$311

New Pricing

Streaming Video

16 hours$999

$311

Digital & Physical Formats

Streaming & DVD

16 hours$1498

$377

Subscribers are eligible for an exclusive Special Offer on the 10-DVD set.

If you are an existing subscriber, please contact our Customer Care team to claim your Special Offer.

Order by Phone

Mon-Fri, 8am-5pm Et

Contact us at 800-336-1618 or 770-536-0309 (Internationally) and you will get a fast, friendly, knowledgeable person to assist you.

LIVE CHAT

Mon-Fri, 8am-5pm ET

Please use the LIVE CHAT button at the bottom right of your screen to chat with us.