Social mood governs the actions of investors and central banks

The image of the Federal Reserve has been much like the Wizard of Oz behind the curtain — pulling just the right levers in the right way to keep the economy humming and the stock market climbing.

However, this is a misconception. As Robert Prechter states in his “must read” book, The Socionomic Theory of Finance:

I studied the Fed’s historical actions and realized that the Fed does not act; it reacts. Social mood pushes the economy around, and it also pushes the Fed around. I realized if you know the trend of social mood you can predict what the Fed will do, but the Fed’s behavior tells you nothing about what financial markets will do.

Nonetheless, investors far and wide still pay close attention to Fed announcements, wanting to glean what’s next for rates, the economy and stocks.

For example, consider this news item from May 19 (CNBC):

Federal Reserve Chair Jerome Powell said Friday that stresses in the banking sector could mean that “our policy rate may not need to rise as much as it would have otherwise to achieve our goals.”

However, the bond market will do what it wants to do, no matter what the Fed says.

On Aug. 21, there was this Bloomberg headline:

Treasury Yields Hit Highest Since 2007 on Elevated Rate Fears

In other words, the mood of investors drives the trend of bond yields (and interest rates), and the Fed reacts.

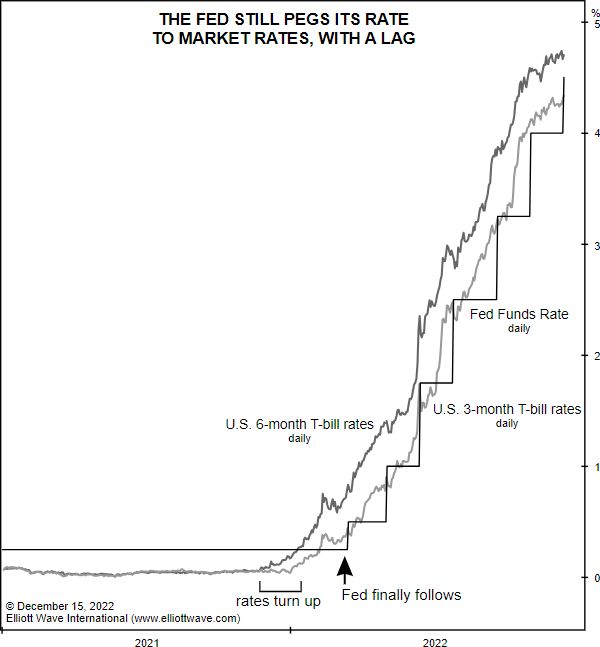

This chart and commentary from the December 2022 Elliott Wave Theorist sheds more light on the topic:

[Here’s a Fed myth]: The Fed is proactive in setting interest rates. It is not. It is 100% reactive and always has been. Chapter 3 in The Socionomic Theory of Finance offers charts proving that central banks around the world follow market-determined rates with an average lag time of five months. They do not “set” rates in any meaningful sense.

[The chart] updates the Fed’s interest-rate activity since mid-2021. As you can see, the Fed’s rate changes have continued to lag rate changes in T-bills as set by the market. The Board’s decisions are not magical or even thoughtful. They look at the market rate, and they adjust the Fed Funds Rate accordingly. That’s all there is to it. That’s all there ever has been to it.

Elliott waves reflect the trends of social mood which drive financial markets, including the bond market.

You can find that Elliott wave analysis in our main investor package.

Follow the link below to learn more.

EWI’s Analysts Don’t React: They Anticipate.

Have you noticed?

Most market prognosticators base their market forecasts on the news… because, well, they assume financial markets react to news.

EWI’s exhaustive research has proven otherwise!

Observations over the decades have shown that market prices are governed by Elliott waves, not exogenous causes.

This enables EWI’s analysts to anticipate.

Learn what our Elliott wave experts anticipate next for stocks, bonds, gold, silver, the U.S. Dollar and the U.S. economy by following the link below.