We’ve all heard the saying, “It’s like money in the bank!”

Of course, that implies rock-solid reliability, or as a dictionary says “… something guaranteed to be useful or beneficial in the future.”

Yet, the literal world of banking is not always as reliable or safe as it seems.

As a reminder, we had that “banking crisis” earlier this year. You’ll probably recall the failures of Silvergate Capital, Silicon Valley Bank, Signature Bank of New York and First Republic Bank, which was the second-largest bank to fail in U.S. history.

We here at Elliott Wave International believe that the potential for another banking crisis is quite high — hence, we’ve prepared a special report titled “Is My Bank Safe?” with the protection of your hard-earned wealth in mind — and you can access it for free by following the link below.

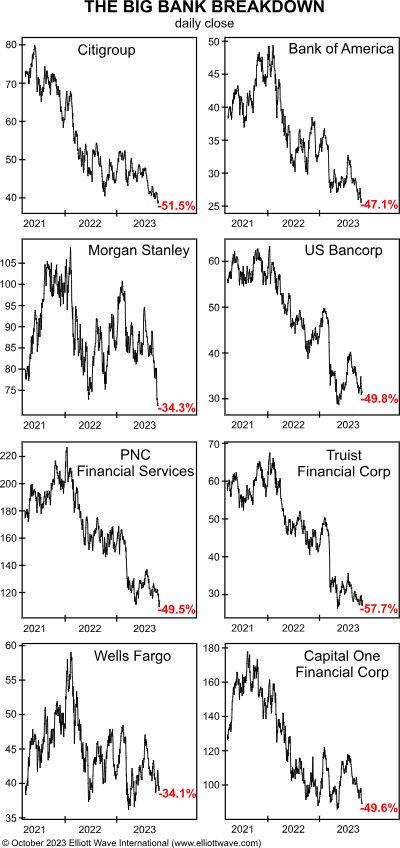

But right now, I want to share with you a group of charts and a quote from our November Elliott Wave Financial Forecast which show that banking-sector woes are also hitting the bigger financial institutions:

Banking-sector pain is no longer confined to medium-sized institutions. [This] series of charts show the share prices for eight of the ten largest U.S. banks. Economists may be largely unaware of it, but these declines illustrate that the “purge” phase of the current credit cycle is underway. It will soon wreak havoc with many sectors of the economy. In November 2022, EWFF stated that the pressure of rising rates was building on bank balance sheets: “The bear market will be recognized as a full-blown financial crisis when some company, hedge fund, bank or sector goes belly up.” Based on the behavior of the shares of the largest and most important U.S. banks, we are well on the way to more devastating failures.

Dig into the details of why the future of the banking-sector is way more precarious than many observers may realize.

Take a big step toward protecting your hard-earned wealth now by accessing our free special report — “Is My Bank Safe?” — just follow the link below.

Is My Bank Safe?

“For bankers to educate depositors about bank safety would be to disturb their main source of profits.”

— Robert Prechter

Banks of all sizes are riskier than they used to be. Think SVB, Silvergate, Credit Suisse and First Republic — all in 2023!

Could your bank be next?

Can the FDIC really guarantee your money?

Read this special report now. It will help you understand the flaws in modern banking, so you can perform your own personal stress test to find out if you can trust your bank.

Don’t put your money at risk. Get answers NOW.