“Chinese real estate is leading the way”

China’s transformation into a global economic superpower took about four decades.

Now, the world’s second largest economy is fighting to maintain economic health.

Yet, things are not looking too encouraging, especially China’s real estate sector.

As our Global Market Perspective noted in September 2022:

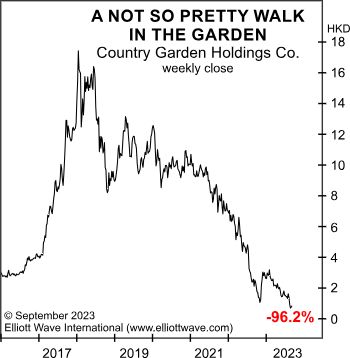

Country Garden Holdings reported a 96% decline in its first-half profit…. The company attributed the decline to “a ‘severe depression,’ some of the strongest language yet to describe the yearlong downturn.”… Chinese real estate is leading the way.

Now, here’s an update from our recently published September 2023 Global Market Perspective:

This chart shows [Country Garden Holdings’] share price plunging to a new low of 69 cents on August 23, which brings the percentage decline from its all-time high in January 2018 to 96.2%. In August, as Country Garden reported a loss of $6.7 billion in the first half of 2023, Bloomberg stated that its “woes threaten even worse fallout than defaulted peer China Evergrande.”

Speaking of which, China Evergrande Group was once China’s largest homebuilder. Trading in its shares was halted by regulators on March 18, 2022 after the firm’s stock price plummeted 95% from its peak 2017 price. When trading re-opened on Aug. 28, we had this headline (Reuters, Aug. 28):

Evergrande loses $2 bln in value as trade resumes…

China Evergrande’s stock price fell another 86.7%.

A day before China Evergrande began trading again, Bloomberg had this headline (Aug. 27):

China’s Worsening Economic Slowdown Is Rippling Across the Globe

One Nobel prize winning economist opined in August that China’s economic troubles will have very little spill over into the United States.

You may want to get our assessment. Look below to learn how.

Will You Believe Your Own Eyes?

Renowned Elliott wave expert Hamilton Bolton once said of Elliott wave analysis:

“The hardest thing is to believe what you see.”

In other words, take the chart pattern at face value — unless and until the price action clearly changes.

Our Elliott wave analysis today suggests a price path in several major global financial markets that will likely catch most investors by surprise.

You can be different. You can be prepared.

Get our latest insights on global stock indexes, bonds, cryptocurrencies, energy, metals, forex and much more — all inside our recently published September Global Market Perspective.

Click on the link below to get started.