What’s another few trillion dollars? U.S. debt is already approaching a historic $37 trillion and now, Congress is discussing adding at least another $3 trillion to the “debt ceiling.” Yes, that’s the phrase that many hear on the news but know little about. Our June Global Rates & Money Flows sheds some historic light on the topic:

Get ready for a summer of apprehension in America as the financial markets fixate on the level of U.S. Federal government debt and whether lawmakers allow the legal limit on it to be (once again) raised. What is the “debt ceiling” and does it really matter?

Simply put, the U.S. debt ceiling refers to a law limiting the amount of money the U.S. government can borrow. Up until 1917, Congress would approve each and every tranche of government borrowing but because World War I was proving so costly, to enable flexibility Congress passed the Second Liberty Bond Act in which it established a limit (ceiling) on the amount of new bonds that could be issued. In 1917 that limit was set at $11.5 billion. Just over a century later it is now $36.1 trillion! In the infamous words of the room service waiter when, having brought champagne and caviar to his hotel room at 3AM, seeing George Best, the world’s greatest footballer at the time, naked along with three Miss World beauty contestants on a bed full of banknotes from casino winnings, ‘Where did it all go wrong?’

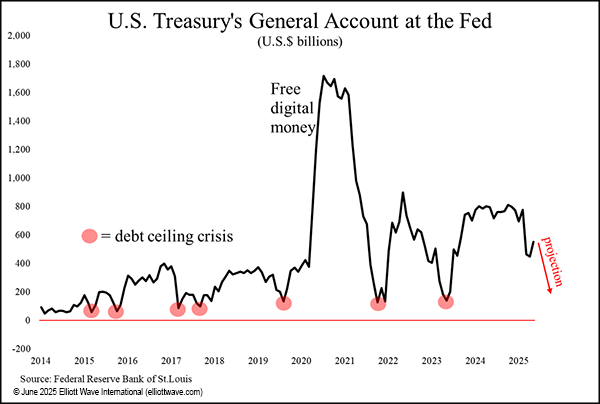

The chart above shows the amount of money in the U.S. Treasury’s General Account that it has at the Federal Reserve Bank. Think of this as just like a checking account we all have at a bank. Receipts, like taxes, come in and expenses, like payroll for government employees and interest on Treasury bonds, go out. The aim, as we all know, is to keep our checking accounts above the zero line.

As you can see, when the account gets towards zero, that is when debt ceiling crises have happened in the past because it means that unless the debt ceiling is either raised or suspended, the Treasury will not be able to pay its day-to-day legal obligations.

Does it matter if the debt ceiling is raised again? Our latest Global Rates & Money Flows answers that question as it provides more insights into a potentially historic debt crisis. Check out our Special Section in the June issue by clicking on the button below.

Want more market insights like this? Sign up to get them sent straight to your inbox – FREE.