Elliott Wave International Master Theme.

-

The U.S. Dollar’s Spiral: More to Go, or A New Trend?

The big financial trend this year has been the stunning decline in the U.S. Dollar. Since January, the Dollar Index itself has seen the most dramatic year-to-date depreciation since1973. Even so, EWI’s Murray Gunn shows that in fact the Dollar Index has unfolded in a textbook Elliott wave pattern. See the labeled chart for yourself…

-

Emerging Market Assets “Steamrolled Ahead” in June: What’s Next?

By plowing upward to multi-year highs in June, emerging market stocks followed the lead of their rising currencies. Global Market Perspective anticipated these parallel trends back in December 2024 … yet, EWI’s Mark Galasiewski expects “plenty of upside ahead.” See the charts and hear Mark’s forecast for yourself in this 60-second video..

-

Is the “SpeculativeJuice”Loose in Europe … or Not?

When stock markets move in the same direction, price action is confirming a larger trend – yet as markets in Europe are instead diverging, we know a larger topping trend may well be at hand. EWI’s Brian Whitmer shows you the charts you won’t see elsewhere.

-

How the EWAVES Engine Nailed the S&P 500 in 2025

EWAVES has been nailing the S&P 500 this year (2025), calling the Feb top and then the April bottom. Elliott Prechter, creator of EWAVES, explains how the engine was built and how it scans thousands of markets to spot high-confidence Elliott wave patterns.

-

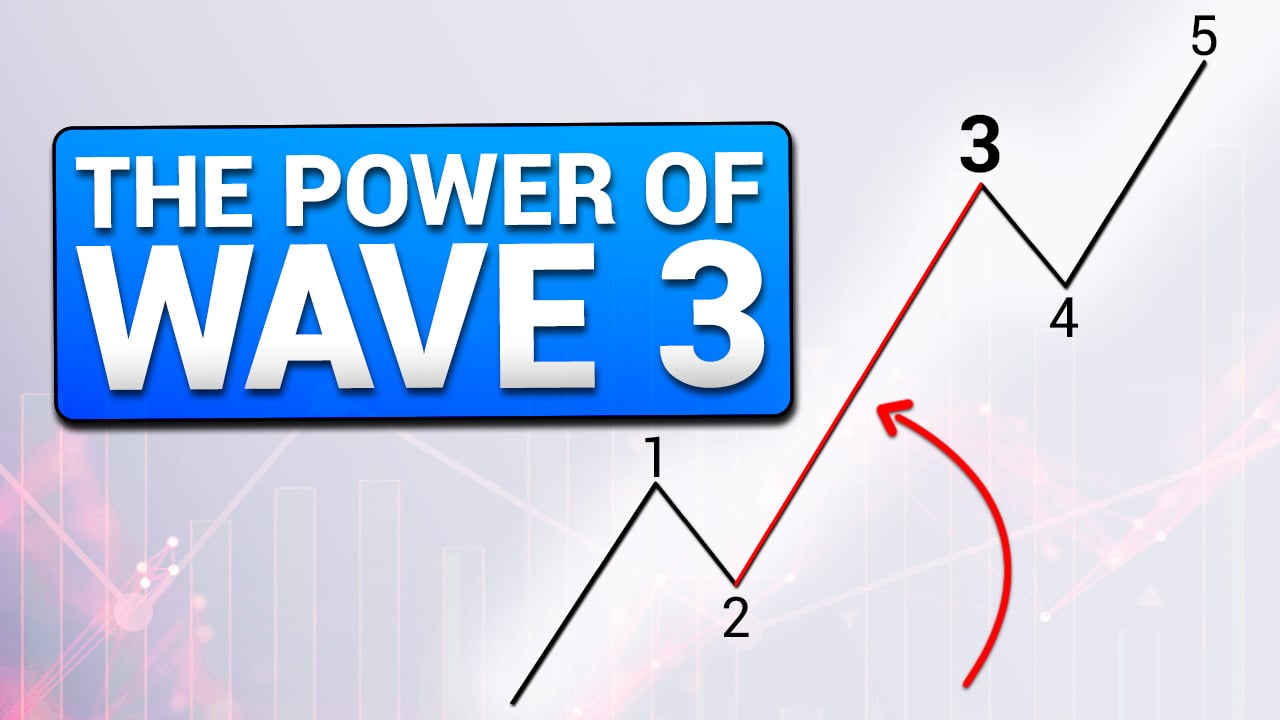

Third Waves Are the Ones You Want to Catch

Of the five waves in an Elliott impulse, the 3rd wave is the one you want to catch. And you definitely don’t want to be on the wrong side of one. Here’s why.

-

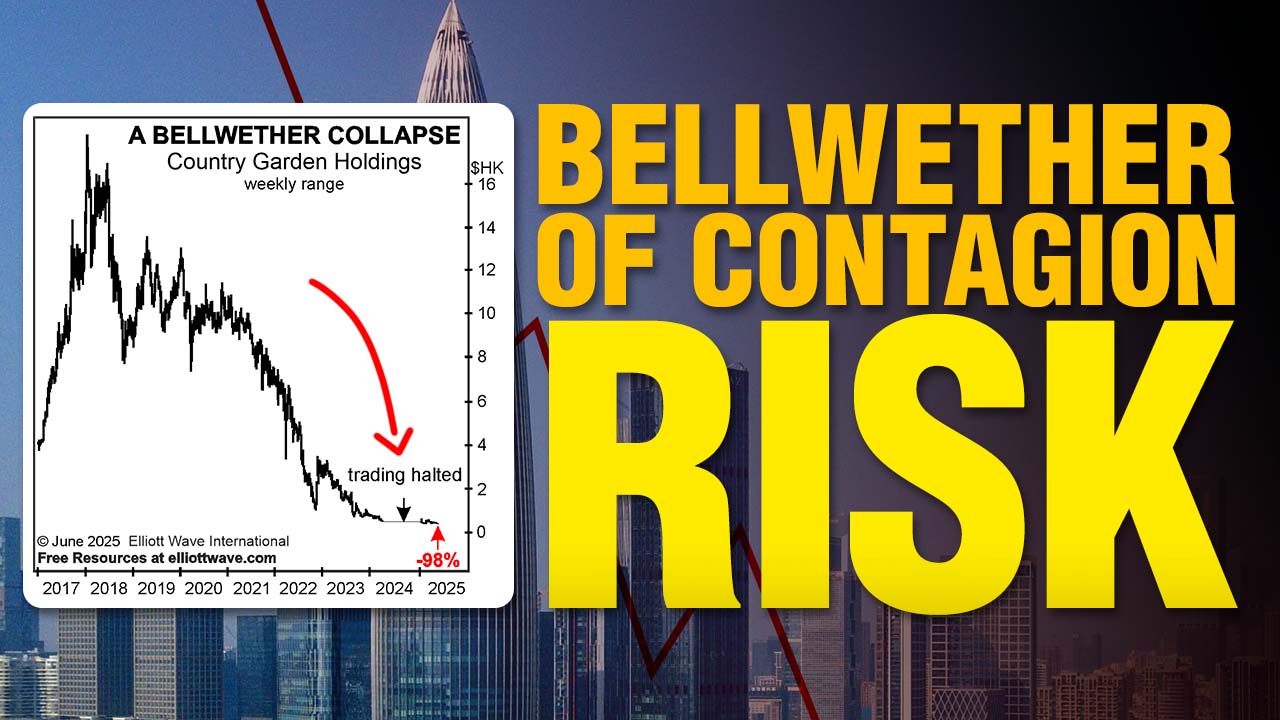

That Can’t Happen Here — Can It?

The world’s second largest economy appears to be on shaky ground. Let’s focus on China’s real estate sector and our analysis of a “bellwether of contagion risk.”

Got any book recommendations?