Topics:

Asian Markets (16) Commodities (13) Crypto (6) Currencies (14) Economy (37) Energy (8) ETFs (5) European Markets (21) Futures (1) Interest Rates (33) Investing (104) Metals (12) Social Mood (19) Stocks (93) Trading (84) US Markets (31)

-

Why Real Estate Prices Soared (and What May Be Next)

-

Europe’s “Fear Index” VIX Equivalent: Why “Quiet” Spells “Dangerous”

-

Market Trek: What 4 Time-Tested “Financial Stress” Indicators Show Today

-

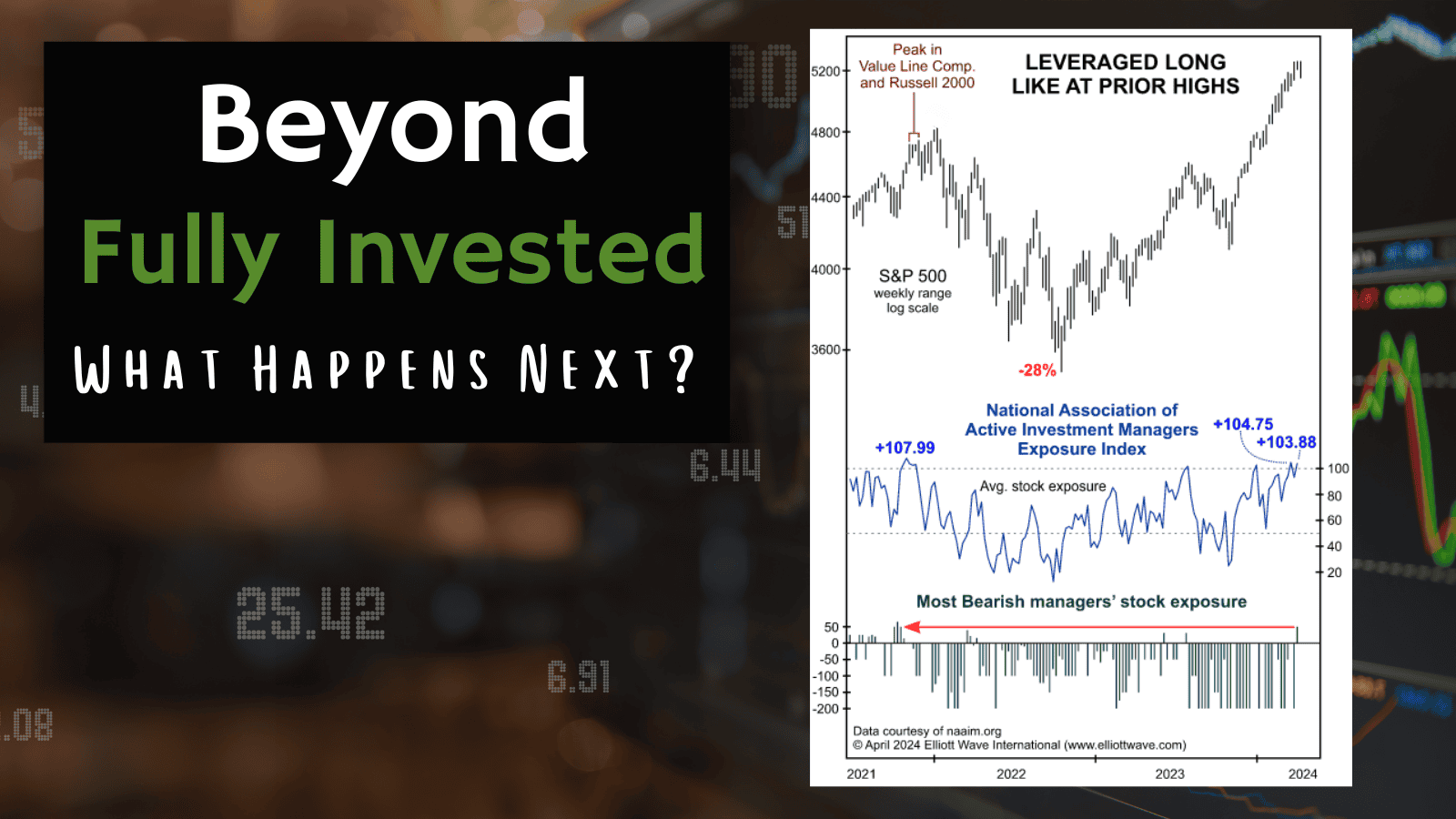

Here’s What Happened Last Time Investment Managers Were This Bullish

-

Beyond “Fully Invested” — What Follows When THAT Happens

-

Market Trek: “$1,000,000,000,000 Every 100 Days”

-

3 Signs of Developing U.S. Economic Slowdown

-

Where the Heck Did the Red-Hot Seller’s Market Go & Is it Ever Coming Back?

-

Grab Hold of a Powerful 3rd Wave – Like This One