News and events do not alter the market’s trend

The trend of the stock market all boils down to investor psychology – which tends to unfold in similar patterns during every market cycle.

An important point to realize is that investor psychology is endogenous, which of course means “having an internal cause or origin.” Another definition in the dictionary is “not attributable to any external or environmental factor.”

This point was driven home when I first became acquainted with the Elliott Wave Principle and read the history of Ralph Nelson Elliott, the accomplished accountant who observed these repetitive stock market patterns while spending time in a hospital with an illness. He noticed, and I’m paraphrasing, that the trend of the stock market was uninterrupted despite World War II! In other words, the endogenous workings of investor psychology persisted even though an external event as significant as a world war had developed.

Besides wars, this applies to other news and events as well – such as terrorist attacks, Federal Reserve announcements, so-called oil “shocks,” “surprising” economic reports, natural disasters, developments in the world of politics and even a presidential assassination. The market may exhibit a relatively brief emotional reaction to dramatic news, but afterwards, the trend picks up where it left off.

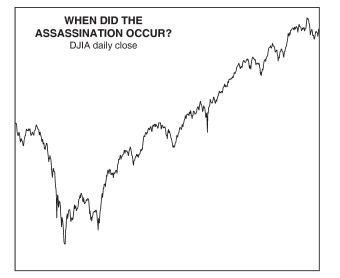

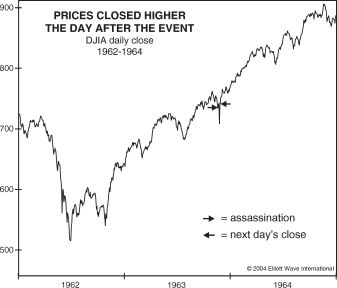

In his landmark book, The Socionomic Theory of Finance, Robert Prechter describes a case in point with these charts and commentary:

[The chart] shows the DJIA around the time when President John F. Kennedy was shot. First of all, can you tell by looking at the graph exactly when that event occurred? Maybe before that big drop on the left? Maybe at some other peak, causing a selloff?

The first arrow [on this next chart] shows the timing of the assassination. The market initially fell, but by the close of the next trading day, it was above where it was at the moment of the event, as you can see by the position of the second arrow.

In the latter half of 1962 and 1963, the trend of the stock market – driven by investor psychology – was up – and continued upward despite historically dramatic news.

Know that Elliott waves are a direct reflection of this investor psychology and can help you anticipate what’s next for financial markets around the globe.

Learn more by following the link below.

The Just-Published February Global Market Perspective Brings You …

… Coverage of 50-plus financial markets in the Asian-Pacific region, Europe and the U.S.

These global markets include stock indexes, individual stocks, cryptocurrencies, forex, bonds, metals, energy and much more.

Our team of analysts opens your eyes to markets that show immediate opportunity – plus markets which might be best to avoid.

Get more insights into our one-of-a-kind monthly Global Market Perspective by following the link below.