Would you buy stocks on the strongest quarterly rise in U.S. GDP over a half-century span?

In his landmark book, the Socionomic Theory of Finance, Robert Prechter reveals 13 market myths which harm investors.

Most investors accept these ideas as true, but they trick investors into making unwise decisions. You can read them all for free by following the link below.

But I want to show you one of these myths, which has to do with a nation’s Gross Domestic Product.

Many market observers believe that GDP has a considerable amount to do with driving the stock market, so we often have headlines like this:

S&P 500 Index Climbs Higher on Better-Than-Expected GDP Growth

Or —

Dow Industrials Plummet on Disappointing GDP Data

Granted, it does seem that a nation’s Gross Domestic Product would have a causal effect on the main indexes. After all, the level of total corporate success is reflected in GDP, and, as you know, stocks are shares in corporations.

Even so, here’s what Robert Prechter notes in the Socionomic Theory of Finance:

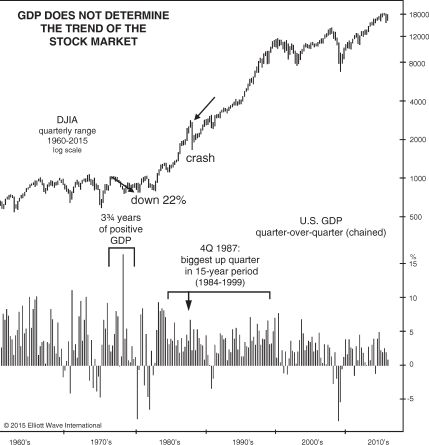

Suppose you knew for certain that GDP would be positive every single quarter for the next 3¾ years and that one of those quarters would surprise economists in sporting the strongest quarterly rise in GDP over a half-century span. Would you buy stocks?

If you had acted on such knowledge in March 1976, you would have owned stocks for four years in which the DJIA fell 22%.

Robert Prechter continues with another example as he shows this chart and says:

Suppose you possessed guaranteed knowledge that the next quarter’s GDP would be the strongest over a span of 15 years. Would you buy stocks?

Had you anticipated precisely this event for Q4 1987, you would have owned stocks for the biggest stock market crash since 1929. GDP, moreover, was in the middle of an extended period of expansion, turning in a positive performance every quarter for thirty straight quarters—twenty before the crash and ten thereafter. But the market crashed anyway. Three years after the start of Q4 1987, stock prices were still below their level of that time despite ten more uninterrupted quarters of rising GDP.

[The chart] shows these two events. It seems that there is something wrong with the idea that investors rationally value stocks according to expansions and contractions in GDP.

Granted, GDP and stock prices are allied much of the time. But if exogenous causality was at work, they would always be allied. Yet, as we’ve shown, they aren’t. In fact, they are often diametrically opposed.

This is only one of the 13 market myths that you will find as you access Chapters 1 and 2 of the Socionomic Theory of Finance for free by following the link below.

Start Reading The Socionomic Theory of Finance Now

Learn About 13 Investor Myths You’re Probably Falling For

- Positive corporate earnings will cause the stock to rally.

- Higher bond yields cause stocks to drop.

- Inflation causes gold and silver prices to rise.

99% of investors hold these irrefutable truths so tightly that they’re willing to invest hundreds-of-thousands of dollars based on these correlations. They never challenge whether they are actually true…

…but Robert Prechter does.

For example, as he states, “Much of the time, GDP and stock prices are allied. But if exogenous causality reigned in this realm, they would always be allied. They aren’t. In fact, they are often diametrically opposed.” This is in contrast to what many market observers believe.

In his groundbreaking text, The Socionomic Theory of Finance, Prechter delves deep into history to study the most popular market cause-and-effects touted by economists, news outlets and brokers.

Read the first two chapters now for free and discover 13 dangerous investor myths.