Warren Buffett is not only famous for being extremely rich, but also for being a value investor.

Of course, that means he seeks to buy good businesses at a bargain.

However, those bargains have been few and far between.

Indeed, as chairman and CEO of Berkshire Hathaway, here’s what he wrote to shareholders in his annual letter on Feb. 24:

“There remain only a handful of companies in this country capable of truly moving the needle at Berkshire, and they have been endlessly picked over by us and by others.”

Buffett added that worthwhile options outside of the U.S. are also lacking. He summed up the investment landscape this way:

“All in all, we have no possibility of eye-popping performance.”

So, the Oracle of Omaha has been holding on to a lot of cash. Here’s a Yahoo! Finance headline (March 2):

Warren Buffett Is Sitting on a Record $167.6 Billion Cash Pile. …

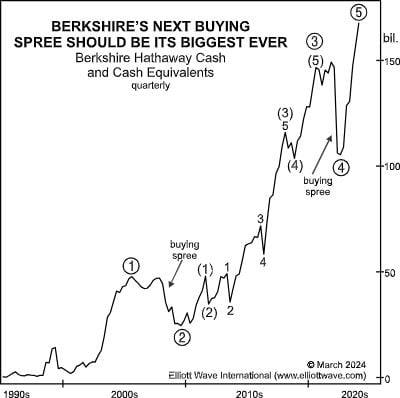

You may be interested in knowing that Berkshire Hathaway’s level of cash and cash equivalents has developed into a clear Elliott wave pattern. Here’s a chart and commentary from our March Global Market Perspective:

The five-wave form of his cash advance is compelling. Not only does it confirm Buffett’s inability to find stock values in the current environment, but it also suggests that some of the deepest equity values of his entire career may be dead ahead. Wave (2), for example, which lasted from Q4 of 2005 through Q2 of 2009, was one of Berkshire’s deepest cash drawdowns. That buying spree ended shortly after the 2008 financial crisis with cash levels falling 48%. Wave (4), another big drawdown, lasted from Q2 of 2020 through Q2 of 2022, as Berkshire snapped up bargains in the wake of the pandemic.

And now, with a record stockpile of cash, Buffet appears well positioned to take advantage of the next stock market downturn.

Of course, no one knows where the exact bottom will be in the next bear market, but it seems likely that Buffet’s biggest buying spree is still ahead.

You may want to review our Elliott wave analysis of major global stock indexes so you can prepare for what we anticipate next.

Just follow the link below and you can have our Global Market Perspective on your screen in minutes.

Is Warren Buffett’s Biggest Buying Spree Still Ahead?

The Oracle of Omaha sits on a record pile of cash

An Elliott wave pattern has developed in Berkshire Hathaway’s cash and cash equivalents which should be of interest to stock market investors. Here’s what that pattern suggests may be next.