Another Bank Failure: How to Tell if Your Bank is At Risk

Murray Gunn, MSTA, CFTe, CEWA, is Head of Global Research at Elliott Wave International. He worked as a fund manager in global bonds, currencies and stocks, including long posts at Standard Life Investments and the Abu Dhabi Investment Authority. Prior to joining EWI, he was Head of Technical Analysis at HSBC Bank. Murray is the author of the 2009 book Trading Regime Analysis and a contributor to Socionomic Studies of Society and Culture (Socionomics Institute Press, 2017). Murray is at the helm of EWI’s Global Rates & Money Flows and The European Short Term Update, while also providing commentary for Global Market Perspective.

Another bank failure, another underperforming share price.

Philadelphia-based Republic First Bank was closed down on Friday and the assets were sold to Fulton Bank. Republic First becomes the first bank failure of 2024 and given our Elliott wave outlook for the stock market (aka the economy), will probably not be the last.

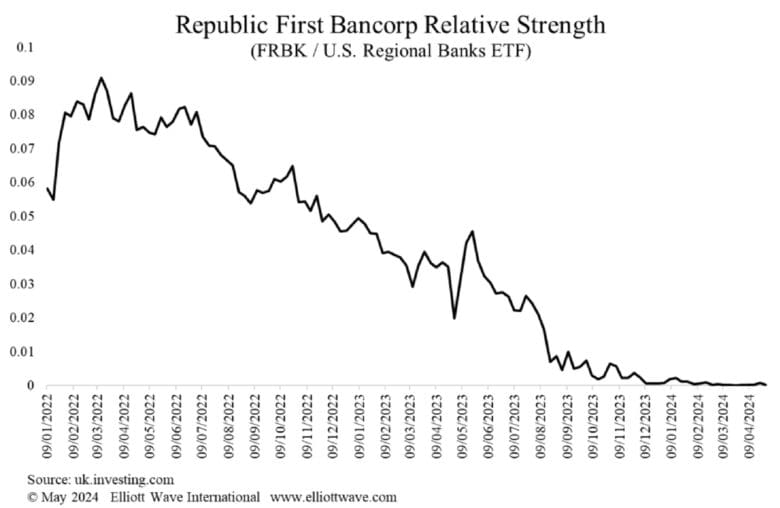

We track the probability of bank failures within the KBW Bank Index by looking at the relative performance of share prices. If the share price is in an underperforming trend, it tells us that something is not right and, therefore, the chance of an underlying weakness emerging is high. We’re working on expanding our coverage to the hundreds of banks in the U.S. but, in the meantime, we would strongly urge you to check the relative performance of your own bank’s share price.

The chart below shows that the share price of Republic First was underperforming the iShares US Regional Banks ETF (ticker IAT) since 2022, with that trend accelerating lower in the summer of 2023. It was a warning that something was up at the bank and, sure enough, existential problems have now emerged. The Republic First Bank failure should not be a surprise to anyone who was tracking the share price.

Discover 5 Solid Alternatives to Banks

In light of recent bank failures and concerns about the vulnerability of the global banking system, many people are (or, in our researched opinion, should be) looking for alternatives to traditional banks.

Our special report “Your 5 Top Alternatives to Banks” gives you actionable ideas to help you protect the bulk of your liquid wealth – and in some of the cases, earn you a nice, healthier-than-banks return along the way.

How do I get it? Join Club EWI for just $2/month. You’ll get the special report PLUS premium articles, helpful videos, trading resources and more. It’s all waiting for you inside Club EWI.

Get Murray Gunn’s research and forecasts in Global Market Perspective, Global Rates & Money Flows and The European Short Term Update.