Topics:

Asian Markets (37) Commodities (32) Crypto (17) Currencies (24) Economy (106) Energy (15) ETFs (13) European Markets (51) Financial Forecast (1) Futures (1) Interest Rates (56) Investing (203) Metals (29) Short Term Update (1) Social Mood (80) Stocks (184) Trading (157) US Markets (111)

-

How the EWAVES Engine Nailed the S&P 500 in 2025

-

Why Do People Buy Shoes at a Discount But Not Stocks?

-

Retail Investors Vs. Warren Buffett

-

Corporate Executives Are Part of the Crowd

-

Houlihan Lokey (HLI): Riding the Trend with Flash and EWAVES

-

Honey, They’re Shrinking the Economy!

-

CBS Eye Takes a Hit

-

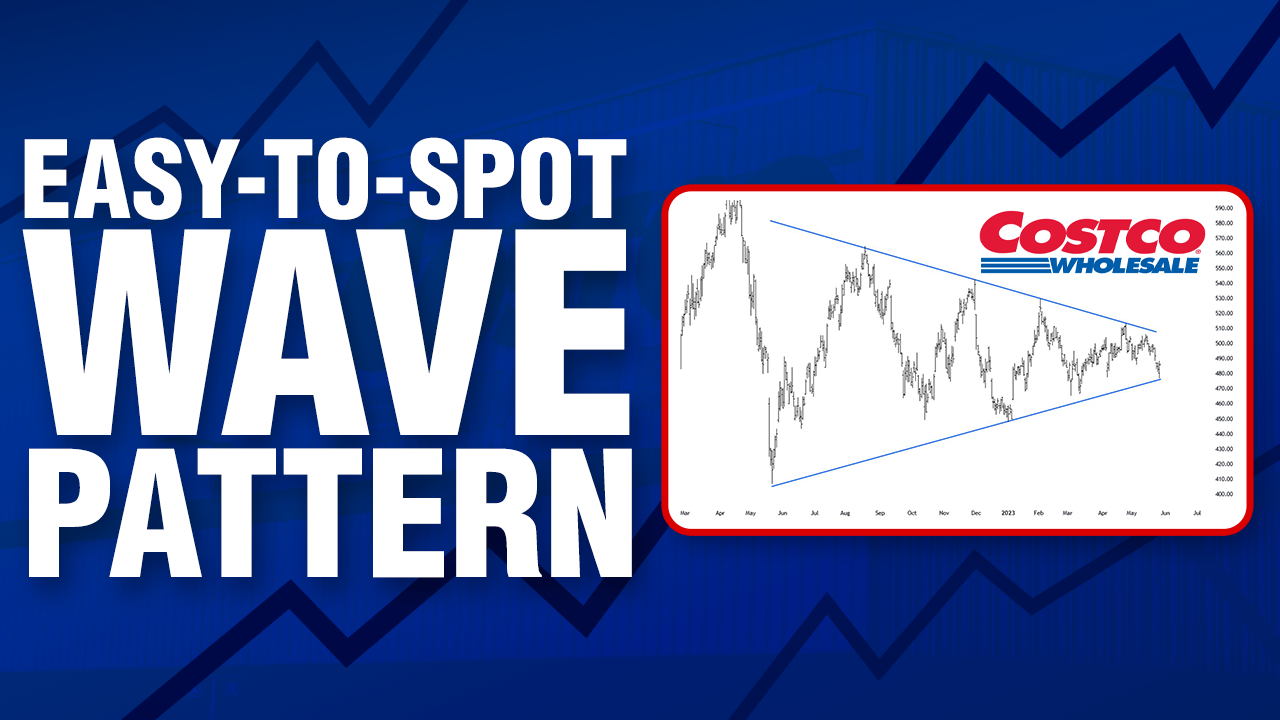

An Elliott Wave Setup You’ll See Again and Again

-

The Perils of Using Earnings to Forecast Stock Prices

-

Elliott Wave Case Study: India’s SENSEX