Elliott Waves for Investors

Challenge the mainstream beliefs on investing. News doesn’t cause the market to move.

Let us show you how wave patterns on a simple price chart can tell you more about the trend than you’ll ever hear on the six o’clock news.

Services for Investors

U.S. Markets

I need forecasts for U.S. markets from the flagship Financial Forecast Service.

European Markets

I need forecasts for European markets from the European Financial Forecast Service.

Asian Markets

I need forecasts for Asian markets from the Asian-Pacific Financial Forecast Service.

Fixed Income Markets

I need analysis of global debt markets, currency trends, and economic insights.

Global Markets

I need clear and actionable analysis and forecasts for the world’s major financial markets.

Social Mood

I need analysis of global trends through the lens of social mood for informed decision-making.

Essential Resources

These resources are some of the best ways to kick off your Elliott wave education, or to refresh your knowledge of the basics.

The Elliott Wave Principle

On Demand Course:

The Basics of the Wave Principle

Recent Commentary for Investors

-

Why You Should Pay Attention to This Time-Tested Indicator Now

-

Market Trek: What 4 Time-Tested “Financial Stress” Indicators Show Today

-

How to Forecast a Market’s Turning Point with Elliott Waves

-

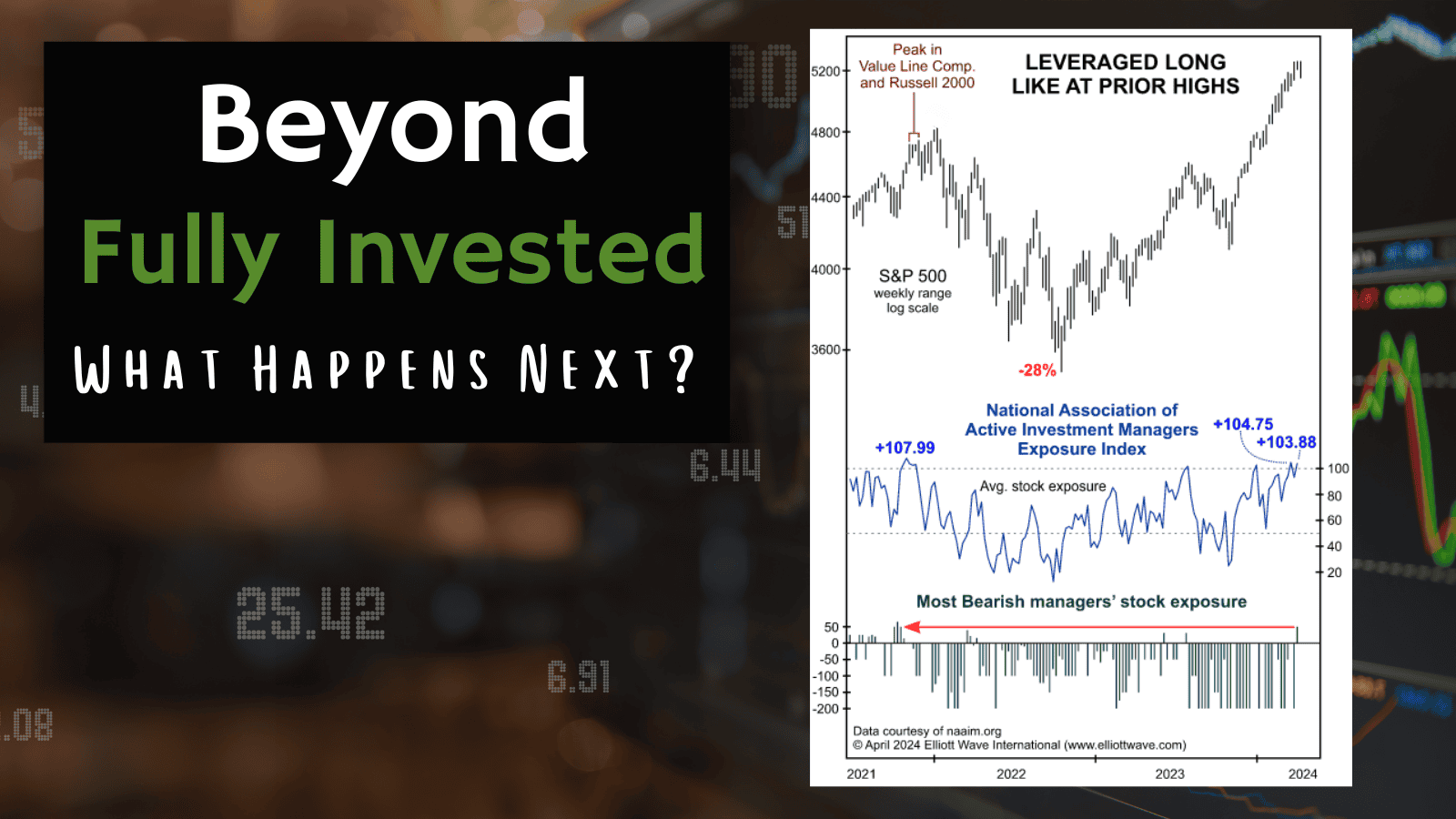

Beyond “Fully Invested” — What Follows When THAT Happens

-

Market Trek: “$1,000,000,000,000 Every 100 Days”